Jedan od starih lisaca, koji je predvidio zadnji bear market od 2000-2002 komentira sadasnje stanje na trzistima i u ekonomiji:

BESPLATNI KOMENTAR SA NJEGOVE STRANICE:

http://www.syharding.com/comm3.html

SOFT LANDING FOR ECONOMY? Feb. 2, 2007.

On Thursday just over a week ago, the Dow lost 112 points, the market closed down for the week, after being flat the previous week. And investor sentiment was suddenly not so optimistic. The poll of its members by the American Association of Individual Investors, which had showed 57.6% to be bullish the previous week, a very high number for this poll, suddenly plunged to just 39.5% bullish. The thought was even widespread on financial TV shows that perhaps the long overdue 10% market correction was finally upon us.

What a difference a few days make.

This week the Fed pushed the clouds away. Talk of ‘Goldilocks’ economic conditions (neither too hot nor too cold), and a soft landing for the economy, became the consensus.

The week got off to a slow start, with the market flat to down Monday and Tuesday. On Wednesday morning came the surprising report that the economy grew at a 3.5% pace in the December quarter. That was up from just 2.0% growth the previous quarter, and considerably stronger than the estimates of a further decline to perhaps 1.5%. Yet even that news could not move the market, which was down for the day on Wednesday until exactly 2:15 p.m. At that moment the Fed ended its January FOMC meeting with the expected announcement that it was leaving interest rates alone. Yawn. Everyone expected that.

But the Fed changed a few words in its announcement of that decision. It said it sees “somewhat firmer economic growth”, whereas in December it said “recent indicators have been mixed”. The other change in its wording was related to inflation. This time it said “readings on core inflation have improved modestly in recent months” which replaced its December phrase “readings on inflation seem elevated”.

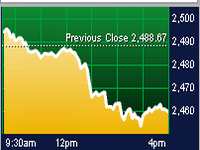

The market immediately reacted on hearing the better economic news from the Fed rather than from individual reports. The Dow reversed to the upside and closed up 98 points for the day, and gained another 52 points on Thursday, which put it at a new high by a fraction.

On Friday morning came the monthly jobs numbers report, the first important look at how the economy was faring in January. And it was also a surprise.

The consensus estimate was that 170,000 new jobs were probably created in December. But the report was that the actual number was only 110,000. However, the jobs numbers previously reported for October through December were revised upward by 104,000.

Adding to the confusion, or at least to the opportunity to interpret the week’s numbers either way, were reports that residential construction declined at a 19.2% annualized rate in the December quarter, while automobile production plunged at an annualized rate of 31.7%. Since home construction and auto sales are two important components of the consumer spending that drives the economy, that had some economists expressing suspicion of the report that the economy grew 3.5% in the quarter.

Merrill Lynch North American economist David Rosenberg warned that the picture isn’t quite as benign (improved growth and low inflation), as the market’s initial reaction to the Fed’s statement indicates.

He claims the drop in oil prices in the December quarter, which contributed to a decline in the U.S. trade deficit, added 1.6% to the fourth quarter GDP number. Without that drop in oil prices, fourth quarter GDP growth would have only been 1.9%, which is more in line with previous forecasts of a still slowing economy. Rosenberg also says that the lower energy costs in the December quarter helped consumer spending jump 4.4% in that quarter, but warns that so far this quarter oil prices are back to the upside. And winter has finally arrived in the U.S. , so the upside reversal in natural gas prices has been even more dramatic than the increase in oil prices.

Rosenberg also notes that the biggest surge in government defense spending since the invasion of Iraq in 2003 took place in the December quarter, and added 0.7% to the reported GDP growth of 3.5%. He believes that aberration, and the end of the decline in oil prices, will result in a return to sickly GDP numbers going forward. And perhaps that is what the market began to think about, as it had little follow through on Friday.

But yet, the S&P 500 was up three out of five days this week, and the Dow managed another fractional new high on Thursday before giving some of it back on Friday.

|

Dakle, ogroman skok jučer, a danas nastavila rast uz downgrade jedne analitičarske kuće. Ja bih rekao da je kandidat za put opcije ili za shorting, ali to bi rekao i jučer, a samo je nastavila rast!

Dakle, ogroman skok jučer, a danas nastavila rast uz downgrade jedne analitičarske kuće. Ja bih rekao da je kandidat za put opcije ili za shorting, ali to bi rekao i jučer, a samo je nastavila rast! Opcije koje sam kupio prije par dana su se vratile na inicijalnu cijenu koliko sam ih i platio nakon poniranja do 20% jučer u minus!

Opcije koje sam kupio prije par dana su se vratile na inicijalnu cijenu koliko sam ih i platio nakon poniranja do 20% jučer u minus! Vijest koja je potaknula pad u stvari potječe od jedne dionice, što je neobičan događaj:

Vijest koja je potaknula pad u stvari potječe od jedne dionice, što je neobičan događaj: Prenosim besplatni komentar sa stranice

Prenosim besplatni komentar sa stranice