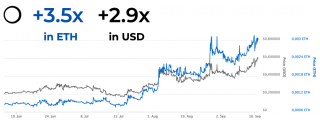

3.5x gain in BMC amid exchange launch

19 rujan 2019The recent release of Blackmoon exchange was extremely well received by the crypto community. This resulted in a three-fold increase in BMC dollar price and a stunning 3.5x outperformance of ethereum.

Price and events timeline

We revealed our plans to upgrade Blackmoon in June 2019, and since then the price of BMC started taking off.

6 June 2019, BMC price $0.21. Monthly digest:

We are currently working on further upgrades of the Blackmoon platform and soon will be ready to announce something special.

12 August 2019, BMC price $0.40. Monthly digest:

a full-blown exchange inside the Blackmoon Platform to provide you with new tools and opportunities <…> The development phase is near completion, testing is next

27 August 2019, BMC price $0.42. Blackmoon to conduct a major platform upgrade:

the release forms the basis for further products and features planned to be rolled out this year. This includes the listing of GRAM token right after Telegram Open Network mainnet launch. Good news for Blackmoon token holders, as BMC utility will soon be significantly expanded.

10 September 2019, BMC price $0.46. Meet new Blackmoon:

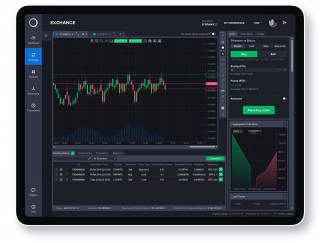

– a fully-featured exchange launched inside the Blackmoon Platform

– many new assets and pairs are now available for depositing, trading and withdrawing

– entirely reworked website, including new Dashboard

After the release, Blackmoon exchange became the main venue for BMC trading. Increased demand from new users, thanks to zero fees in BMC pairs, resulted in further price appreciation to $0.61 as of 18 September 2019.

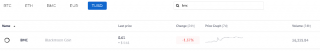

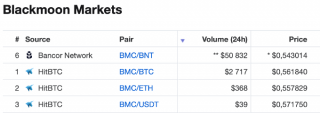

Price inefficiencies

Because Blackmoon price feed is not on the CoinMarketCap yet, 5–10% price differences between the exchanges are a common thing.

Blackmoon exchange 2019–09–18 09.54.47 UTC:

CoinMarketCap 2019–09–18 09.56.31 UTC:

BMC/USDT pair on Blackmoon has outpaced the volume of Bancor. The total 24-h volume of BTC versus BTC, ETH, TUSD and EUR was 170,341.74.

Over time we believe that the prices well level across multiple exchanges eliminating possibilities for arbitrage.

Road ahead

Blackmoon exchange has huge plans for the coming months, including:

1. Listing of real Grams after Telegram Open Network launch. The Backmoon Platform users will enjoy deep liquidity, thanks to our partnership with Gram Vault — the largest Gram token custodian.

2. Platform enhancements.

These include:

- trading API

- Credit/Debit cards withdrawals

- Quick exchange for mobile devices. Currently, trading on mobile devices is unavailable (except for some high-resolution tablets like iPad Pro 12.9).

3. VIP Program for BMC owners to receive extra privileges, including lower trading fees, higher rebate rate in the referral program, bonuses during special events and more.

Stay tuned for our updates, test the Blackmoon Exchange functionality and receive a $20 prize while doing this. Learn more.

Handy links to stay tuned to our updates:

website: https://blackmoon.net

telegram channel: https://t.me/blackmooncryptochannel

twitter: https://twitter.com/BlackmoonFG

reddit: https://www.reddit.com/r/BlackMoonCrypto/

facebook: https://www.facebook.com/blackmoonfg

DISCLAIMER

Subject to regional restrictions and terms of use.

Due to the fact that digital currency and digital token markets are unregulated and decentralized, the provision of our services is not governed by any investor protection rules. Investment in digital currency carries a high degree of risk and volatility and is not suitable for every investor; therefore, you should not risk the capital you cannot afford to lose. This post is for information only and does not constitute solicitation or investment advice.

komentiraj (0) * ispiši * #

Blackmoon to conduct a major platform upgrade

27 kolovoz 2019A list of the forthcoming changes

To get you prepared for the upcoming release, we are going to unveil the features that will be available to you soon.

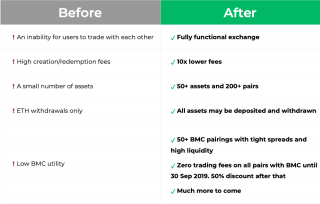

What’s behind these changes?

This release addresses the main problems of our users:

Moreover, the release forms the basis for further products and features planned to be rolled out this year. This includes the listing of GRAM token right after Telegram Open Network mainnet launch. Good news for Blackmoon token holders, as BMC utility will soon be significantly expanded.

New features in detail

This update will allow you to:

1. Easily trade on a fully functional exchange

Market, limit and stop orders

High liquidity and tight spreads on all pairs

Low trading fees (0.1% — maker, 0.2% — taker)

Advanced trading interface

2. Have access to 50+ assets and 200+ trading pairs, including fiat

No more creation/redemption fees

The assets are traded in five markets — against EUR, TUSD, BTC, ETH and BMC

Zero trading fees on all pairs with BMC until 30 Sep 2019. 50% discount after that

All assets may be deposited and withdrawn, thanks to the BitGo solution

3. Manage your portfolio effectively

Convenient tools to control and monitor your balances

!omprehensive information on the trading pairs

A chart with your portfolio performance

4. Be even more confident in the Blackmoon Platform

Safety of your funds is of primary importance for us. We have successfully passed a security audit by a Big Four company. All digital assets are held in the cold storage of the largest global custodians. Rigorous firewalls and Secure Sockets Layer (SSL) software is used to protect your information during transmission. All communications between our clients and data servers are encrypted.

When?

We anticipate this transformation to take place in a matter of days, so be ready to test new functionality soon.

To celebrate the release, we will launch several promo events, including a big trading festival, so stay tuned for further announcements.

Handy links to stay tuned to our updates:

website: https://blackmoon.net

telegram channel: https://t.me/blackmooncryptochannel

twitter: https://twitter.com/BlackmoonFG

reddit: https://www.reddit.com/r/BlackMoonCrypto/

facebook: https://www.facebook.com/blackmoonfg

DISCLAIMER

Due to the fact that digital currency and digital token markets are unregulated and decentralized, the provision of our services is not governed by any investor protection rules. Investment in digital currency carries a high degree of risk and volatility and is not suitable for every investor; therefore, you should not risk the capital you cannot afford to lose. Please consult an independent professional financial or legal advisor to ensure the product meets your objectives before you decide to invest.

komentiraj (0) * ispiši * #

Blackmoon Digest - August 2019

12 kolovoz 2019Large updates always take time… In the past month, the team was working hard on a major release awaiting us this August. Today, we would like to guide you through what’s been done in recent years and shed some light on the upcoming changes.

The road so far

In March 2018, Blackmoon presented a platform which allowed the crypto community to access traditional financial markets without leaving the blockchain ecosystem.

Fiat products

We opened our product line by tokenizing two of the most popular Exchange Traded Funds (ETFs). These were SPDR S&P 500 ETF (tracks top 500 US companies) and iShares MSCI EM ETF (tracks companies from emerging markets). Two months later, Blackmoon offered investors to participate in the Xiaomi IPO with crypto! The offering was met with high interest from the public. This motivated us to tokenize another two IPOs — Uber and Lyft. While doing this, we accumulated a ton of experience, allowing us to remove the lock-up period for our users and commence trading right after the actual listing on stock exchanges.

In August 2018, we tokenized a real hedge fund (Prime Meridian REL), providing our users with access to institutional-grade investment. Other than tokenizing already existing financial instruments, Blackmoon developed its own products — Thematic Portfolios. A thematic portfolio is composed of stocks bundled together by the same theme/idea. Currently, investors have access to the Water, eGaming and Brexit thematic portfolios.

Crypto products

In 2018, Blackmoon expanded its product line with proprietary designed crypto strategies. All of them are created on the principles of automatic execution, responsiveness to recent market changes, data consistency and diversification. As of now, there are nine crypto strategies and each one is different depending on the risk/reward profile and underlying algorithm.

Side projects

Parallel to the development of our product line, we launched two side projects. The first one, STO — a simplified way to raise capital and provide liquidity for equity through a security token offering. The second one, Apollo — a fast and effective way to convert illiquid coins.

Platform developments

For the past years, Blackmoon not only has released 18 products but has also been constantly improving the Platform by adding new functionality.

This includes:

Dashboard — a convenient tool to track all available products, instantly buy and sell them 24/7 on one page, without using external wallets.

A possibility to buy cryptocurrencies and our products via a debit/credit card.

Simplified registration and fast verification process.

To ensure compliance of our products, procedures and developments, Blackmoon continuously monitors the market as well as the regulatory environment. The platform is built in line with the highest security standards. Our sustainability was validated by a security audit conducted by a Big 4 company — a true rarity in the crypto industry.

As of now, Blackmoon investors can create a truly diversified portfolio depending on their risk/reward profile. The range of the proposed products allows users to weather the storm periods in the crypto market and to benefit from the bull runs.

What’s next?

Crypto world is vibrant and dynamic. Market participants make millions of investment decisions on a wide range of cryptocurrencies. Their expectations shift frequently and quite dramatically. To meet our users’ needs, we are launching a full-blown exchange inside the Blackmoon Platform to provide you with new tools and opportunities.

%Highlights of the changes%

Users will be able to trade with each other in a fully functional trading interface

Many new assets and trading pairs (including fiat pairs)

10x lower trading fees

Reworked dashboard where you can manage your portfolio and monitor the markets

BMC parings with discounted trading fees. (Overall, BMC utility will soon be significantly expanded. You may have noticed rising interest from investors reflected in notable BMC price appreciation.)

The development phase is near completion, testing is next. We will announce the detailed list of new features in the days to come.€

List of publications on Medium blog

Blackmoon Digest. July 2019

Don’t buy Grams before TON goes live

Handy links to stay tuned to our updates:

Website: https://blackmoonplatform.com

Telegram channel: https://t.me/blackmooncryptochannel

Facebook: https://www.facebook.com/blackmoonfg/

Twitter: https://twitter.com/BlackmoonFG

Reddit: https://www.reddit.com/r/BlackMoonCrypto/

DISCLAIMER

Investment in cryptocurrencies carries a high degree of risk and volatility and is not suitable for every investor; therefore, you should not risk the capital you cannot afford to lose. Please consult an independent professional financial or legal adviser to ensure the product meets your objectives before you decide to invest. Regional restrictions and suitability checks apply.

komentiraj (0) * ispiši * #

Blackmoon Weekly Product Report - Week 32, 2019

07 kolovoz 2019Here is the weekly product report for week 32 2019.

Check the returns :)

Thank you.

Website: https://blackmoonplatform.com

Telegram channel: https://t.me/blackmooncryptochannel

Facebook: https://www.facebook.com/blackmoonfg/

Twitter: https://twitter.com/BlackmoonFG

Reddit: https://www.reddit.com/r/BlackMoonCrypto/

DISCLAIMER

Investment in cryptocurrencies carries a high degree of risk and volatility and is not suitable for every investor; therefore, you should not risk the capital you cannot afford to lose. Please consult an independent professional financial or legal adviser to ensure the product meets your objectives before you decide to invest. Regional restrictions and suitability checks apply.

komentiraj (0) * ispiši * #

Interview with Moshe Joshua, CPO of Blackmoon, about Telegram and Libra

31 srpanj 2019"I think Telegram and Facebook are taking the right approach. It is their ecosystem, it is their users and they have to protect their brand to be able to make a promise that it will be fully permissionless." - Moshe Joshua, CPO of Blackmoon.

Please watch the full interview - https://blocktv.com/watch/2019-07-30/5d402b7987c17-libra-may-be-grabbing-the-headlines-but-don-t-forget-gram

komentiraj (0) * ispiši * #

Don’t buy Grams before TON goes live

26 srpanj 2019Telegram’s Gram is the most anticipated coin. Numerous exchanges and crypto shops are trying to catch the hype and offer their clients so-called Gram futures. Buying unhedged futures is very risky. Why so? There are three reasons for that.

1. You may never get your profits or money back.

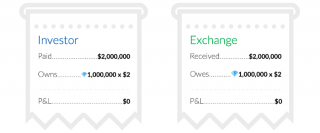

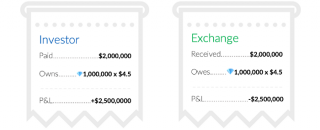

Let’s draw a simple example.

A futures contract is a legal agreement to buy or sell a particular commodity or asset at a predetermined price at a specified time in the future.

Investopedia.

Assume that an exchange sells 1 million contracts at $2 per Gram:

Upon the launch of TON and the actual trading of real Grams, the true price of Grams will be determined. If the price hits $4.5 per Gram, investors would see paper profits. Yet it is an open question whether investors would be able to cash out:

For the investors to see their profits, the exchange would have to find somewhere 1 mln of Grams, now worth $4,500,000. If these futures are backed by real Grams, there is no issue. Still, it’s a known fact that original investors in TON are prohibited from selling their stakes before the TON goes live.

This means, that the majority of the exchanges are selling naked futures and will have to buy Grams in the open market to pay the investors. In this case, exchanges are at a loss and have to find the money elsewhere. In our view, taking the credit risk of the exchange is too risky.

If the fact that you may never see the profits from the questionable deal is not convincing, here is a couple of additional issues with Gram futures.

2. The transaction might be illegal.

Futures are considered to be financial instruments in most jurisdictions. Given the fact that the majority of shops selling and trading the futures are not regulated, this may raise issues with the regulators. This problem is even more important for those exchanges who sell the futures to the US investors in a clear violation of SEC rulings.

Should there be probes from the regulators, this could result in a run on the exchange with a detrimental effect on the price of the exchange-listed futures.

3. The price might be artificial.

Trading on these exchanges usually has a very low volume. Low depth of the market means that the price might be manipulated even by relatively small orders. This could also result in extraordinary price behavior like in the screenshot below. The price increased 4-fold and plummeted as low as $0.12 in a short period amid near-zero trading:

Another interesting pattern is the stickiness of price to $2. It’s worth noting that in June and July all trading activity evaporated completely.

Given the fact that all futures are not tokens and could not be transferred to another exchange, there is no way for the arbitrageurs to profit on price discrepancies.

Conclusion

Indeed, Gram is going to make a big bang when TON goes live. It might be compelling to get exposure to Grams rather sooner than later, but it’s not worth the risk. The potential risks to investors are as follows:

No backing by real Grams;

No compliance with regulations;

No liquidity.

As a result, investors at best may not see their profits or lose all the money in the worst-case scenario. Patience pays off. Stay tuned for the news and wait for real Grams to be listed on trustworthy exchanges.

komentiraj (0) * ispiši * #

Will Facebook and Telegram Kill Bitcoin and Ethereum?

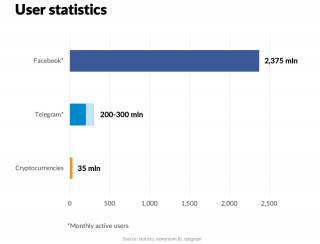

23 srpanj 20192019 has marked itself not only with the end of the crypto winter but also with time when established technology companies entered the blockchain field. Telegram is going to release its own blockchain with the goal of processing millions of transactions per second. Facebook plans to introduce Libra coin to facilitate payments for 1.7 billion unbanked but connected people.

These companies bring in not only experienced teams and massive war chests but also existing user bases and use cases. And this could be all the difference.

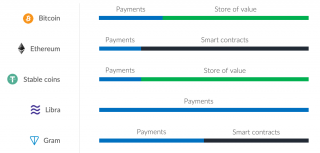

According to the economic theory, the price of an asset is driven by its intrinsic value. It turns out that major cryptocurrencies do have intrinsic value, driven by their use cases. To answer the question of whether the rise of Gram and Libra would mark the end for Bitcoin and Ethereum, we need to analyze their use cases and a brief history of the blockchain.

Bitcoin and blockchain 1.0

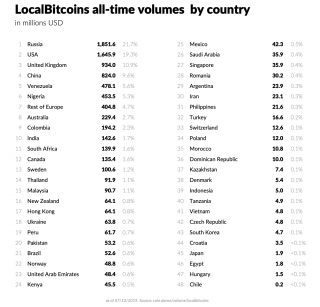

Despite all the hype with its price swings, Bitcoin is genuinely used as a means of payment between the parties, especially when it comes to cross-border payments.

Indeed, Bitcoin’s seven transactions per second might seem to be awfully long when it comes to paying for the pizza. But this is lightning fast for a transborder payment. This is why many websites that sell adds and freelance content writers accept bitcoin.

It’s hardly a surprise to see that Bitcoin has a meaningful adoption in the underbanked countries.

The table above also shows that people use Bitcoin as a store of value in countries with high inflation, like Venezuela. We also saw an uptick in Bitcoin trading activity in Turkey amid recent turbulence in the country and economy.

Because of the fact that Bitcoin is the oldest cryptocurrency and is decentralized, traders adopted it as a digital gold to store value in cold wallets.

It is an open question to what extent Bitcoin price is defined by speculative trading and what remains to these use cases, still if there is any fundamental value of Bitcoin it is driven by them.

Ethereum and blockchain 2.0

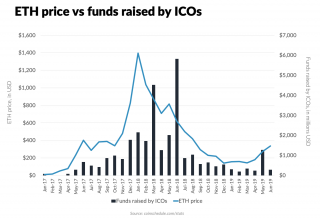

Ethereum opened up a new way of operating with digital assets. In fact, Ethereum created digital assets by means of ERC-20 tokens and Initial Coin Offerings.

Most of them were using smart contracts and hence accepted only ETH. Even when an ICO accepted Bitcoin and other cryptos, participants favored ETH for the speed of transactions. All this resulted in congestion of the network during highly anticipated ICOs.

It is hardly a surprise that the ETH price skyrocketed amid the growing number of ICOs back in 2017 and fell back accordingly.

With the ICO volume decreasing, leaving the space to IEO, the use cases for Ethereum have narrowed to support ERC tokens of other projects and niche collectibles like crypto kitties, puppies, cuties and the like.

Thanks to the easiness to create and transact an ERC-20 token, Ethereum created a boost for asset-backed coins, including stable coins.

Stable coins and blockchain 2.5

Not all stable coins are Ethereum-based. For instance, controversial Tether has the majority of the tokens operating on Omni blockchain. Still, the proliferation of various stable coins is a recent development.

The use case for stable coins manifests itself in the very name. Stable coins are used as a proxy to fiat currencies and hence, the store of value. It is the closest traders could have to get into cash amid market meltdowns and projects that are willing to cash out by selling crypto assets. One could refer to the sale of round 1 Grams on Liquid exchange where only USD and USDC were accepted.

There are two major issues that limit the use cases of stable coins:

Trust;

Mass adoption.

Trust affects above all the store of value use case. Should the users believe that the stable coin is not fully asset-backed, its value shall deteriorate. This is exactly what happened to Tether in early 2017 and late 2018.

Mass adoption affects the payments use case. If it is difficult to accept payment, the transaction is unlikely to happen.

Libra and blockchain 2.6

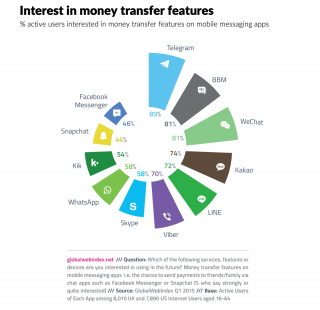

The launch of Libra by a consortium of companies led by Facebook will open a new epoch for blockchain adoption, even though it’s not actually a blockchain. Thanks to the massive user base of Facebook, WhatsApp, and Instagram, the soon-to-be-launched digital currency will have multiple use cases.

The major use cases are sending money and paying for goods and services. It’s not a surprise that the leading payment providers joined the Libra Association: Visa, MasterCard, and PayPal, to name a few.

Given the fact that Libra is going to be a stable coin, pegged to a basket of low volatile currencies, it poses an existential threat to blockchain 2.5 multiple and diverse stable coins issued by less known companies. Why should people bother using any other stable coin if one could send money directly from her Facebook account?

It will not be a surprise that the blockchain will end up with an 800-pound gorilla of Libra coin and one or two USD-pegged coin with proven reserves of fiat to serve a proxy for USD.

The open question is whether Libra poses a threat to Bitcoin. On the one hand, Libra will limit the use cases of Bitcoin. Especially that of money remittance for the underbanked. On the other, the weight of regulation and capital controls in exactly these underbanked countries tells me that Bitcoin will survive.

Libra is going to be regulated one way or another. With a centralized entity, be it Facebook or Libra Association, local regulators will send requests, subpoenas and so on. And unlike with Bitcoin regulators would have leverage since Facebook will not take the risk of being blocked by the IP.

Also, Facebook tarnished reputation after Cambridge Analytica and centralized nature of Libra will keep away those who favor decentralization. Hence even though Libra will kill the majority of existing stable coins, Bitcoin use cases will survive.

Telegram Open Network and blockchain 3.0

Telegram blockchain and its native token Gram are set to be the killer of Ethereum. TON offers the same functionality as Ethereum but on the next level, including scalability and speed of transactions. Most importantly, Telegram has approximately a 300 million user base which dwarves the audience of all cryptocurrencies combined.

Switching cost for the crypto community will be negligible as Telegram is already a default means of communication.

The image of ultra-libertarian Mr. Durov and Telegram reluctance to share user data with governments are dramatically more appealing to the crypto community when compared to Mr. Zukerberg and Facebook.

Telegram messenger has already a vibrant bot functionality. Introduction of the native blockchain for micro-payments alone is a solid use case. Expected support of smart-contracts together with fast confirmations leave no meaningful use cases for Ethereum. Most likely, Ethereum technology would continue like the current Enterprise Ethereum Alliance and serve the needs of companies with private blockchains.

Another solid use case for TON and Grams is payments from one user to another. This is the place where Grams are more likely to clash with Libra and Bitcoin.

For the former, Telegram competes for the same functionality of in-app payments, mainly in underbanked countries. All while Telegram certainly lacks the vibrant commerce functionality of Instagram and Facebook, it tries to play on the weaknesses of the competitor when it comes to the privacy of user data. For instance, in May Mr. Durov commented on the lack of security in WhatsApp. It’s yet to be seen whether the TON ecosystem would have sufficient e-commerce oriented use cases to compete with Facebook’s Libra.

As for the latter, Telegram has potential to substitute Bitcoin when it comes to Bitcoin’s value transmission use case.

Should TON be truly decentralized and Telegram successfully continue dodging IP blocking in certain countries, there are more reasons for people to adopt faster app-based transactions in Grams than stick to Bitcoin.

Surviving blockchains and their use cases

2020 is going to mark itself with the rise of new blockchains and decline of some existing ones.

Bitcoin will remain more of a digital gold and the means of payment for those who believe in hard-core decentralization, losing use cases to Libra and Gram.

Ethereum is likely to see a decline amid narrowing use cases and technical superiority of TON.

Most of the stable coins will go extinct without making it to the broad adoption mainly because of Libra becoming the trusted stable coin with use cases beyond cryptocurrency trading. For the cryptocurrency trading, we will see one or two stable coins staying in the game to be the proxy for cash.

Libra will be the currency of choice for e-commerce and money remittance for the underbanked. Most likely, we will see challenger banks entering the space to provide credit and accepting deposits in Libra. Still, the centralized nature of Libra and an open question regarding the support of smart contracts leaves plenty of room for TON.

TON is going to experience the same dynamics as Ethereum in its early days but has the better prospects than Ethereum thanks to the existing user base and infrastructure for micropayments in bots that could become governed by the smart contracts. Ultimately we will see certain competition between Libra and Gram, but this is a long shot and a topic for another article.

You can find more stories by Sergey Vasin here.

DISCLAIMER

Investment in cryptocurrencies carries a high degree of risk and volatility and is not suitable for every investor; therefore, you should not risk the capital you cannot afford to lose. Please consult an independent professional financial or legal adviser to ensure the product meets your objectives before you decide to invest. Regional restrictions and suitability checks apply.

komentiraj (0) * ispiši * #

Blackmoon Digest July 2019

08 srpanj 2019Dear Blackmooners!

Short but true monthly digest for you.

1. This month was fully dedicated to the development of major platform upgrades awaiting us this summer. The team is working hard on key integrations that will serve as a foundation for the massive extension of functionality. We have a big announcement coming soon — stay tuned.

2. We would like to stress your attention to the fact that we moved to the new domain — Blackmoon.net. Blackmoonplatform.com now redirects to the new one.

3. We initiated a short survey to get to know you better and adjust our product accordingly.

It will take less than 3 minutes!

I Please take the survey - https://bit.ly/2XPzGi6

Website: https://blackmoonplatform.com

Telegram channel: https://t.me/blackmooncryptochannel

Facebook: https://www.facebook.com/blackmoonfg/

Twitter: https://twitter.com/BlackmoonFG

Reddit: https://www.reddit.com/r/BlackMoonCrypto/

DISCLAIMER

Investment in cryptocurrencies carries a high degree of risk and volatility and is not suitable for every investor; therefore, you should not risk the capital you cannot afford to lose. Please consult an independent professional financial or legal adviser to ensure the product meets your objectives before you decide to invest. Regional restrictions and suitability checks apply.

komentiraj (0) * ispiši * #

Navigating the ebb and flow of money in crypto

27 lipanj 2019Bitcoin’s march is in full swing. During such runs, some investors hold the majority of their portfolios in BTC, while the others try to catch strong movements in altcoins with much lesser capitalizations. Active traders seek to timely switch between BTC and alts to increase the total value in BTC and not only in USD.

There are some fascinating patterns and interdependencies in the crypto world that may help you decide which strategy to employ.

Correlation

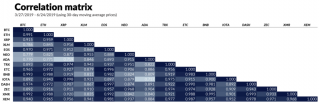

You’ve probably heard that cryptocurrencies are highly correlated and seen a matrix like that:

For those who have not. A correlation matrix is a table showing correlation coefficients between variables. The coefficient indicates the strength and direction of a linear relationship between two random variables. In our case, between the prices of two coins. A correlation coefficient is always between +1 and -1. A value of 0 indicates that there is no linear relationship between the prices of two coins. A value of +1 indicates that the prices perfectly mimic each other, a value of -1 is the same as +1 but the prices change in the opposite directions. In our example, the smallest coefficient is 0.717 between IOTA and ADA, it is considered a strong positive relationship.

The table shows some useful information:

“herd behavior”, major coins follow along pretty much the same path

diversification opportunities among the top coins are not that great since there is evidence of a strong positive relationship between them. To effectively diversify you need low/not high correlation among portfolio constituents.

The matrix, however, hides some important peculiarities of cash flow movements in crypto, which is going to be the main focus of this article.

The law of communicating vessels

Have ever noticed that when BTC is strong and is about to skyrocket, altcoins stand humbly in its shadow? Bitcoin literally siphons funds from other cryptocurrencies. When the run is over and BTC is on break, money flows back to altcoins which, in turn, come to the forefront quickly closing the gap. This pattern recurs consistently in the bull market. For a better understanding, let’s take a closer look at the recent surge of BTC in the context of some large-cap altcoins quoted against it.

You can clearly see the phases in which BTC moves up absorbing money from the market and where it takes a break allowing altcoins to get their share of glory. Interestingly enough, this latest quick drop from $11,200 to $10,300 (22 Jun ’19) was not continued by the same reaction, altcoins further depreciate in BTC. Does it mean that the run isn’t over yet? According to this pattern

—

yes. Probably, by the time this article is published, the answer will be already plotted on the live chart. You can check it here (press the button on the chart to load new bars).

Hindsight

On the road to 20k in late 2017, the same pattern was present. Money has been moving between BTC and altcoins forming similar cycles.

An obvious question: how it all ended up with respect to our observations?

After 7 Dec ’17, beginning from a standard correction of BTC, altcoins started ignoring its further movements and were steadily appreciating in BTC. Around the red vertical line, where altcoins started entering the “green zone” against BTC the market finally collapsed. It does not mean that the next huge correction will be happening in the same way, however, when the pattern is broken, you should be especially cautious.

Conclusion

First, the charts above can help you understand in which state of a bull run we currently are. Second, if you are an active trader, this information may assist in the decision-making of whether to stay in BTC or switch to alts. This indicator should not be used as a decisive factor, but rather as a supplementary tool.

There are other intriguing aspects of money flows in crypto that are not covered in this article. This relates to how market manipulators force average traders to make mistakes by pumping BTC separately from altcoins, plus how they make additional profits with smaller initial cash outflow by knowing the order in which altcoins will be pumped. Maybe there will be an article on this topic too.

Sobering reminder

Looking at this crazy daily chart of BTC/USD and monitoring all this positive news you should be careful, the market is reaching its boiling point. Avoid leverage and decisions based on the feeling of missing opportunity, stay safe.

Handy links to stay tuned to our updates:

Website: https://blackmoonplatform.com

Telegram channel: https://t.me/blackmooncryptochannel

Facebook: https://www.facebook.com/blackmoonfg/

Twitter: https://twitter.com/BlackmoonFG

Reddit: https://www.reddit.com/r/BlackMoonCrypto/

DISCLAIMER

Investment in cryptocurrencies carries a high degree of risk and volatility and is not suitable for every investor; therefore, you should not risk the capital you cannot afford to lose. Please consult an independent professional financial or legal adviser to ensure the product meets your objectives before you decide to invest. Regional restrictions and suitability checks apply.

komentiraj (0) * ispiši * #

It's Official - New and Shorter Blackmoon Domain Ahead

26 lipanj 2019Dear Blackmooners,

We have a lot of changes ahead of us, that is why we will move to a new domain BLACKMOON.NET this week.

Current domain name blackmoonplatform.com will remain with redirection to the new. The only action you need - refresh login with your login/password and 2FA (we strongly recommend to use it).

In case of any questions please contact information@blackmoon.net.

Kind regards,

Blackmoon Team

komentiraj (0) * ispiši * #