Brexit Thematic Portfolio

BMxBRXT

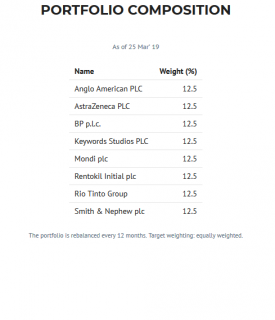

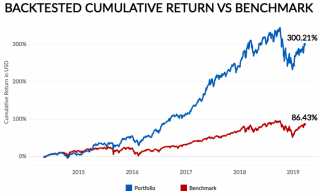

Brexit Thematic Portfolio creates a unique opportunity to capitalize on one of the most important events in modern European history, Brexit. The portfolio tracks the performance of the largest UK exporting companies that are predisposed to benefit from the Brexit event.

More innovative investment opportunities to come!

Four new products were added to the Blackmoon Platform this month. We are not content with these achievements and will continue providing our users with innovative investment opportunities. In the nearest future, our product collection will expand significantly, so stay tuned!

Handy links to stay tuned to our updates:

website: blackmoonplatform.com

telegram channel: https://t.me/blackmooncryptochannel

info video: https://youtu.be/6Ii0XckQOAE

DISCLAIMER

Investment in financial instruments carries a significant risk of loss and may not BE suitable for every investor. Before purchasing our investment products, please consider your level of experience, investment objectives and risk appetite, and consult an independent financial or legal advisor to ensure the product meets your objectives. Please note that your investments do not have capital protection and carry a risk of loss, including the loss of the entire investment amount; therefore, you should not risk the capital you cannot afford to lose. This material is presented for information purposes only and does not constitute a solicitation or investment advice.