Iraq and the hidden euro-dollar wars by F. William Engdahl, USA/Germany

Despite the apparent swift U.S. military success in Iraq, the U.S. dollar has yet to benefit as safe haven currency. This is an unexpected development, as many currency traders had expected the dollar to strengthen on the news of a U.S. win. Capital is flowing out of the dollar, largely into the Euro. Many are beginning to ask whether the objective situation of the U.S. economy is far worse than the stock market would suggest. The future of the dollar is far from a minor issue of interest only to banks or currency traders. It stands at the heart of Pax Americana, or as it is called, The American Century, the system of arrangements on which America’s role in the world rests.

Yet, even as the dollar is steadily dropping against the Euro after the end of fighting in Iraq, Washington appears to be deliberately worsening the dollar fall in public comments. What is taking place is a power game of the highest geopolitical significance, the most fateful perhaps, since the emergence of the United States in 1945 as the world’s leading economic power.

The coalition of interests which converged on war against Iraq as a strategic necessity for the United States, included not only the vocal and highly visible neo-conservative hawks around Defense Secretary Rumsfeld and his deputy, Paul Wolfowitz. It also included powerful permanent interests, on whose global role American economic influence depends, such as the influential energy sector around Halliburton, Exxon Mobil, ChevronTexaco and other giant multinationals. It also included the huge American defense industry interests around Boeing, Lockheed-Martin, Raytheon, Northrup-Grumman and others. The issue for these giant defense and energy conglomerates is not a few fat contracts from the Pentagon to rebuild Iraqi oil facilities and line the pockets of Dick Cheney or others. It is a game for the very continuance of American power in the coming decades of the new century. That is not to say that profits are made in the process, but it is purely a bypro-duct of the global strategic issue.

In this power game, least understood is the role of preserving the dollar as the world reserve currency, as a major driving factor contributing to Washington’s power calculus over Iraq in the past months. American domination in the world ultimately rests on two pillars — its overwhelming military superiority, especially on the seas; and its control of world economic flows through the role of the dollar as the world’s reserve currency. More and more it is clear that the Iraq war was more about preserving the second pillar – the dollar role – than the first, the military. In the dollar role, oil is a strategic factor.

American Century: the three phases

If we look back over the period since the end of World War II, we can identify several distinct phases of evolution of the American role in the world. The first phase, which began in the immediate postwar period 1945-1948 and the onset of Cold War, could be called the Bretton Woods Gold Exchange system.

Under the Bretton Woods system in the immediate aftermath of the World War, the order was relatively tranquil. The United States had emerged from the War clearly as the one sole superpower, with a strong industrial base and the largest gold reserves of any nation. The initial task was to rebuild Western Europe and to create a NATO Atlantic alliance against the Soviet Union. The role of the dollar was directly tied to that of gold. So long as America enjoyed the largest gold reserves, and the U.S. economy was far the most productive and efficient producer, the entire Bretton Woods currency structure from French Franc to British Pound Sterling and German Mark was stable. Dollar cre-dits were extended along with Marshall Plan assistance and credits to finance the rebuil-ding of war-torn Europe. American companies, among them oil multinationals, gained nicely from dominating the trade at the onset of the 1950’s. Washington even encouraged creation of the Treaty of Rome in 1958 in order to boost European economic stability and create larger U.S. export markets in the bargain. For the most part, this initial phase of what Time magazine publisher Henry Luce called ‘The American Century’, in terms of economic gains, was relatively ‘benign’ for both the U.S. and Europe. The United States still had the economic flexibility to move.

This was the era of American liberal foreign policy. The United States was the hegemonic power in the Western community of nations. As it commanded overwhelming gold and economic resources compared with Western Europe or Japan and South Korea, the United States could well afford to be open in its trade relations to European and Japanese exports. The tradeoff was European and Japanese support for the role of the United Sates during the Cold War. American leadership was based during the 1950’s and early 1960’s less on direct coercion and more on arriving at consensus, whether in GATT trade rounds or other issues. Organizations of elites, such as the Bilderberg meetings, were organized to share the evolving consensus between Europe and the United States.

This first, more benign phase of the American Century came to an end by the early 1970’s.

The Bretton Woods Gold Exchange began to break down, as Europe got on its feet economically and began to become a strong exporter by the mid-1960’s. This growing economic strength in Western Europe coincided with soaring U.S. public deficits as Johnson escalated the tragic war in Vietnam. All during the 1960’s, France’s de Gaulle began to take its dollar export earnings and demand gold from the U.S. Federal Reserve, legal under Bretton Woods at that time. By November 1967 the drain of gold from U.S. and Bank of England vaults had become critical. The weak link in the Bretton Woods Gold Exchange arrangement was Britain, the ‘sick man of Europe’. The link broke as Sterling was devalued in 1967. That merely accelerated the pressure on the U.S. dollar, as French and other central banks increased their call for U.S. gold in exchange for their dollar reserves. They calculated with the soaring war deficits from Vietnam, it was only a matter of months before the United States itself would be forced to devalue against gold, so better to get their gold out at a high price.

By May 1971 the drain of U.S. Federal Reserve gold had become alarming, and even the Bank of England joined the French in demanding U.S. gold for their dollars. That was the point where rather than risk a collapse of the gold reserves of the United States, the Nixon Administration opted to abandon gold entirely, going to a system of floating currencies in August 1971. The break with gold opened the door to an entirely new phase of the American Century. In this new phase, control over monetary policy was, in effect, privatized, with large international banks such as Citibank, Chase Manhattan or Barclays Bank assuming the role that central banks had in a gold system, but entirely without gold. ‘Market forces’ now could determine the dollar. And they did with a vengeance.

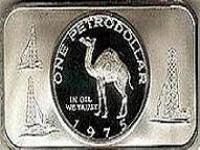

The free floating of the dollar, combined with the 1973 rise in OPEC oil prices by 400% after the Yom Kippur War, created the basis for a second phase of the American Century, the Petrodollar phase.

Recycling petrodollars

Beginning the mid-1970’s the American Century system of global economic dominance underwent a dramatic change. An Anglo-American oil shock suddenly created enormous demand for the floating dollar. Oil importing countries from Germany to Argentina to Japan, all were faced with how to export in dollars to pay their expensive new oil import bills. OPEC oil countries were flooded with new oil dollars. A major share of these oil dollars came to London and New York banks where a new process was instituted. Henry Kissinger termed it, ‘recycling petrodollars’. The recycling strategy was discussed already in May 1971 at the Bilderberger meeting in Saltsjoebaden, Sweden. It was presented by American members of Bilderberg, as detailed in the book Mit der ¬waffe zur Weltmacht.

OPEC suddenly was choking on dollars it could not use. U.S. and UK banks took the OPEC dollars and relent them as Eurodollar bonds or loans, to countries of the Third World desperate to borrow dollars to finance oil imports. The buildup of these petrodollar debts by the late 1970’s, laid the basis for the Third World debt crisis in the 1980’s. Hundreds of billions of dollars were recycled between OPEC, the London and New York banks and back to Third World borrowing countries.

By August 1982 the chain finally broke and Mexico announced it would likely default on repaying Eurodollar loans. The Third World debt crisis began when Paul Volcker and the U.S. Federal Reserve had unilaterally hiked U.S. interest rates in late 1979 to try to save the failing dollar. After three years of record high U.S. interest rates, the dollar was ‘saved’, but the entire developing sector was choking economically under usurious U.S. interest rates on their petrodollar loans. To enforce debt repayment to the London and New York banks, the banks brought the IMF in to act as ‘debt policeman’. Public spending for health, education, welfare was slashed on IMF orders to ensure the banks got timely debt service on their petrodollars.

The Petrodollar hegemony phase was an attempt by the United States establishment to slow down its geopolitical decline as the hegemonic center of the postwar system. The IMF ‘Washington Consensus’ was developed to enforce draconian debt collection on Third World countries, to force them to repay dollar debts, prevent any economic independence from the nations of the South, and keep the U.S. banks and the dollar afloat. The Trilateral Commission was created by David Rockefeller and others in 1973 in order to take account of the recent emergence of Japan as an industrial giant and try to bring Japan into the system. Japan, as a major industrial nation, was a major importer of oil. Japanese trade surpluses from export of cars and other goods was used to buy oil in dollars. The remaining surplus was invested in U.S. Treasury bonds to earn interest. The G-7 was founded to keep Japan and Western Europe inside the U.S. dollar system. From time to time into the 1980’s various voices in Japan would call for three currencies — dollar, German mark and yen — to share the world reserve role. It never happened. The dollar remained dominant.

From a narrow standpoint, the Petrodollar phase of hegemony seemed to work. Underneath, it was based on ever-worsening economic decline in living standards across the world, as IMF policies destroyed national economic growth and broke open markets for globalizing multinationals seeking cheap production outsourcing in the 1980’s and especially into the 1990’s.

Yet, even in the Petrodollar phase, American foreign economic policy and military policy was dominated by the voices of the traditional liberal consensus. American power depended on negotiating periodic new arrangements in trade or other issues with its allies in Europe, Japan and East Asia.

A Petro-euro rival?

The end of the Cold War and the emergence of a new Single Europe and the European Monetary Union in the early 1990’s, began to present an entirely new challenge to the American Century. It took some years, more than a decade after the 1991 Gulf War, for this new challenge to emerge full-blown. The present Iraq war is only intelligible, as a major battle in the new, third phase of securing American dominance. This phase has already been called, ‘democratic imperialism’, a favorite term of Max Boot and other neo-conservatives. As Iraq events suggest, it is not likely to be very democratic, but definitely likely to be imperialist.

Unlike the earlier periods after 1945, in the new era, the U.S. freedom to grant concessions to other members of the G-7 is gone. Now raw power is the only vehicle to maintain American long-term dominance. The best expression of this argument comes from the neo-conservative hawks around Paul Wolfowitz, Richard Perle, William Kristol and others.

The point to stress, however, is that the neo-conservatives enjoy such influence since September 11 because a majority in the U.S. power establishment finds their views useful to advance a new aggressive U.S. role in the world.

Rather than work out areas of agreement with European partners, Washington increasingly sees Euroland as the major strategic threat to American hegemony, especially ‘Old Europe’ of Germany and France. Just as Britain in decline after 1870 resorted to increasingly desperate imperial wars in South Africa and elsewhere, so the United States is using its military might to try to advance what it no longer can by economic means. Here the dollar is the achilles heel.

With creation of the Euro over the past five years, an entirely new element has been added to the global system, one which defines what we can call a third phase of the American Century. This phase, in which the latest Iraq war plays a major role, threatens to bring a new, malignant or imperial phase to replace the earlier phases of American hegemony. The neo-conservatives are open about their imperial agenda, while more traditional U.S. policy voices try to deny it. The economic reality faced by the dollar at the start of the new Century, defines this new phase in an ominous way.

There is a qualitative difference emerging between the two initial phases of the American Century — that of 1945-1973, and of 1973-1999 — and the new emerging phase of continued domination in the wake of the 9.11 attacks and the Iraq War. Post-1945 American power before now, was predominately that of a hegemon. While a hegemon is the dominant power, in an unequal distribution of power, its power is not generated by coercion alone, but also by consent among its allied powers. This is because the hegemon is compelled to perform certain services to the allies such as military security or regulating world markets for the benefit of the larger group, itself included. An imperial power has no such obligations to allies, and not the freedom for such, only the raw dictates of how to hold on to its declining power — what some call ‘imperial overstretch’. This is the world which neo-conservative hawks around Rumsfeld and Cheney are suggesting America has to dominate, with a policy of pre-emptive war.

A hidden war between the dollar and the new Euro currency for global hegemony is at the heart of this new phase.

To understand the importance of this unspoken battle for currency hegemony, we first must understand that since the emergence of the United States as the dominant global superpower after 1945, U.S. hegemony has rested on two un-challengeable pillars. First, the overwhelming U.S. military superiority over all other rivals. The United States today spends on defense more than three times the total for the entire European Union, some $ 396 billion versus $118 billion last year, and more than the next 15 largest nations combined. Washington plans an added $ 2.1 trillion over the coming five years on defense. No nation or group of nations can come close in defense spending. China is at least 30 years away from becoming a serious military threat. No one is serious about taking on U.S. military might.

The second pillar of American dominance in the world is the dominant role of the U.S. dollar as reserve currency. Until the advent of the Euro in late 1999, there was no potential challenge to this dollar hegemony in world trade. The Petrodollar has been at the heart of the dollar hegemony since the 1970’s. The dollar hegemony is strategic to the future of American global pre-dominance, in many respects as important if not more so, than the overwhelming military power.

Dollar fiat money

The crucial shift took place when Nixon took the dollar off a fixed gold reserve to float against other currencies. This removed the restraints on printing new dollars. The limit was only how many dollars the rest of the world would take. By their firm agreement with Saudi Arabia, as the largest OPEC oil producer, the ‘swing producer’ Washington guaranteed that the world’s largest commodity, oil, the essential for every nation’s economy, the basis of all transport and much of the industrial economy, that oil could only be purchased in world markets in dollars. The deal had been fixed in June 1974 by Secretary of State Henry Kissinger, establishing the U.S.-Saudi Arabian Joint Commission on Economic Cooperation. The U.S. Treasury and the New York Federal Reserve would ‘allow’ the Saudi central bank, SAMA, to buy U.S. Treasury bonds with Saudi petrodollars. In 1975 OPEC officially agreed to sell its oil only for dollars. A secret U.S. military agreement to arm Saudi Arabia was the quid pro quo.

Until November 2000, no OPEC country dared violate the dollar price rule. So long as the dollar was the strongest currency, there was little reason to as well. But November was when French and other Euroland members finally convinced Saddam Hussein to defy the United States by selling Iraq’s oil-for-food not in dollars, ‘the enemy currency’ as Iraq named it, but only in euros. The euros were on deposit in a special UN account of the leading French bank, BNP Paribas. Radio Liberty of the U.S. State Department ran a short wire on the news and the story was quickly hushed.

This little-noted Iraq move to defy the dollar in favor of the euro, in itself, was insignificant. Yet, if it were to spread, especially at a point the dollar was already weakening, it could create a panic selloff of dollars by foreign central banks and OPEC oil producers. In the months before the latest Iraq war, hints in this direction were heard from Russia, Iran, Indonesia and even Venezuela. An Iranian OPEC official, Javad Yarjani, delivered a detailed analysis of how OPEC at some future point might sell its oil to the EU for euros not dollars. He spoke in April, 2002 in Oviedo Spain at the invitation of the EU. All indications are that the Iraq war was seized on as the easiest way to deliver a deadly pre-emptive warning to OPEC and others, not to flirt with abandoning the Petro-dollar system in favor of one based on the euro.

Informed banking circles in the City of London and elsewhere in Europe privately confirm the significance of that little-noted Iraq move from petro-dollar to petro-euro. ‘The Iraq move was a declaration of war against the dollar’, one senior London banker told me recently. ‘As soon as it was clear that Britain and the U.S. had taken Iraq, a great sigh of relief was heard in London City banks. They said privately, “now we don’t have to worry about that damn euro threat”’.

Why would something so small be such a strategic threat to London and New York, or to the United States that an American President would apparently risk fifty years of alliance relations globally, and more to make a military attack whose justification could not even be proved to the world?

The answer is the unique role of the petro-dollar to underpin American economic hegemony.

How does it work? So long as almost 70% of world trade is done in dollars, the dollar is the currency which central banks accumulate as reserves. But central banks, whether China or Japan or Brazil or Russia, do not simply stack dollars in their vaults. Currencies have one advantage over gold. A central bank can use it to buy the state bonds of the issuer, the United States. Most countries around the world are forced to control trade deficits or face currency collapse. Not the United States. This is because of the dollar reserve currency role. And the underpinning of the reserve role is the petrodollar. Every nation needs to get dollars to import oil, some more than others. This means their trade targets dollar countries, above all the U.S.

Because oil is an essential commodity for every nation, the Petrodollar system, which exists to the present, demands the buildup of huge trade surpluses in order to accumulate dollar surpluses. This is the case for every country but one — the United States which controls the dollar and prints it at will or fiat. Because today the majority of all international trade is done in dollars, countries must go abroad to get the means of payment they cannot themselves issue. The entire global trade structure today works around this dynamic, from Russia to China, from Brazil to South Korea and Japan. Everyone aims to maximize dollar surpluses from their export trade.

To keep this process going, the United States has agreed to be ‘importer of last resort’ because its entire monetary hegemony depends on this dollar recycling.

The central banks of Japan, China, South Korea, Russia and the rest all buy U.S. Treasury securities with their dollars. That in turn allows the United States to have a stable dollar, far lower interest rates, and run a $ 500 billion annual balance of payments deficit with the rest of the world. The Federal Reserve controls the dollar printing presses, and the world needs its dollars. It is as simple as that.

The U.S. foreign debt threat

But, not so simple perhaps. This is a highly unstable system, as U.S. trade deficits and net debt or liabilities to foreign accounts are now well over 22% of GDP as of 2000, and climbing rapidly. The net foreign indebtedness of the United States—public as well as private—is beginning to explode ominously. In the past three years since the U.S. stock collapse and the re-emergence of budget deficits in Washington, the net debt position, according to a recent study by the Pestel Institute in Hanover, has almost doubled. In 1999, the peak of the dot.com bubble fury, U.S. net debt to foreigners was some $ 1.4 trillions. By the end of this year, it will exceed an estimated $ 3.7 trillion! Before 1989, the United States had been a net creditor, gaining more from its foreign investments than it paid to them in interest on Treasury bonds or other U.S. assets. Since the end of the Cold War, the United States has become a net foreign debtor nation to the tune of $3.7 trillion! This is not what Hilmar Kopper could call ‘peanuts’.

It does not require much foresight to see the strategic threat of these deficits to the role of the United States. With an annual current account (mainly trade) deficit of some $500 billion, some 5% of GDP, the United States must import or attract at least $1.4 billion every day, to avoid a dollar collapse and keep its interest rates low enough to support the debt-burdened corporate economy. That net debt is getting worse at a dramatic pace. Were France, Germany, Russia and a number of OPEC oil countries to now shift even a small portion of their dollar reserves into euro to buy bonds of Germany or France or the like, the United States would face a strategic crisis beyond any of the postwar period. To pre-empt this threat, was one of the most strategic hidden reasons for the decision to go for ‘regime change’ as it is known, in Iraq. It is as simple and as cold as this. The future of America’s sole superpower status depended on pre-empting the threat emerging from Eurasia and Euroland especially. Iraq was and is a chess piece in a far larger strategic game, one for the highest stakes.

The euro threatens the hegemony

When the euro was launched at the end of the last decade, leading EU government figures, bankers from Deutsche Bank’s Norbert Walter, and French President Chirac went to major holders of dollar reserves — China, Japan, Russia — and tried to convince them to shift out of dollars at least a part of their reserves, and into euros. However, that clashed with the need to devalue the too-high euro, so German exports could stabilize Euroland growth. A falling euro was the case until 2002.

Then, with the debacle of the U.S. dot.com bubble bursting, the Enron and Worldcom finance scandals, and the recession in the U.S., the dollar began to lose its attraction for foreign investors. The euro gained steadily until the end of 2002. Then, as France and Germany prepared their secret diplomatic strategy to block war in the UN Security Council, rumors surfaced that the central banks of Russia and China had quietly began to dump dollars and buy euros. The result was a dollar free-fall on the eve of war. The stage was set should Washington lose the Iraq war, or it turn into a long, bloody debacle.

But Washington, leading New York banks and the higher echelons of the U.S. establishment clearly knew what was at stake. Iraq was not about ordinary chemical or even nuclear weapons of mass destruction. The ‘weapon of mass destruction’ was the threat that others would follow Iraq and shift to euros out of dollars, creating mass destruction of the United States’ hegemonic economic role in the world. As one economist termed it, an end to the dollar reserve role would be a ‘catastrophe’ for the United States. Interest rates of the Federal Reserve would have to be pushed higher than in 1979 when Paul Volcker raised rates above 17% to try to stop the collapse of the dollar then. Few realize that 1979 dollar crisis was also a direct result of moves by Germany, and France, under Schmidt and Giscard, to defend Europe together with Saudi Arabia and others who began selling U.S. Treasury bonds to protest Carter Administration policy. It is also worth recalling that after the Volcker dollar rescue, the Reagan Administration, backed by many of today’s neo-conservative hawks, began a huge U.S. military defense spending to challenge the Soviet Union.

Eurasia versus the Anglo-American Island Power

This fight over petro-dollars versus petro-euros, which started in Iraq, is by no means over, despite the apparent victory of the United States in Iraq. The euro was created by French geopolitical strategists for establishing a multipolar world after the collapse of the Soviet Union. The aim was to balance the overwhelming dominance of the U.S. in world affairs. Significantly, French strategists rely on a British geopolitical strategist to develop their rival power alternative to the U.S., namely Sir Halford Mackinder.

This past February, a French intelligence-connected newsletter, Intelligence Online, wrote a piece, ‘The Strategy Behind Paris-Berlin-Moscow Tie’. Referring to the UN Security Council bloc of France-Germany-Russia to try to prevent the U.S.-British war moves in Iraq, the Paris report notes the recent efforts of European and other powers to create a counterpower to that of the United States. Referring to the new ties of France with Germany and more recently with Putin, they note, ‘a new logic, and even dynamic seems to have emerged. An alliance between Paris, Moscow and Berlin running from the Atlantic to Asia could foreshadow a limit to U.S. power. For the first time since the beginning of the 20th Century, the notion of a world heartland—the nightmare of British strategists—has crept back into international relations.’

Mackinder, father of British geopolitics, wrote in his remarkable paper, ‘The Geographical Pivot of History’ that the control of the Eurasian heartland, from Normandy France to Vladivostock, was the only possible threat to oppose the naval supremacy of Britain. British diplomacy until 1914 was based on preventing any such Eurasian threat, that time around the expansion policy of the German Kaiser eastwards with the Baghdad Railway and the Tirpitz German Navy buildup. World War I was the result. Referring to the ongoing efforts of the British and later Americans to prevent a Eurasian combination as rival, the Paris intelligence report stressed, ‘That strategic approach (i.e. to create Eurasian heartland unity) lies at the origin of all clashes between Continental powers and maritime powers (UK, U.S. and Japan) ... It is Washington’s supremacy over the seas that, even now, dictates London’s unshakeable support for the U.S. and the alliance between Tony Blair and Bush.’

Another well-connected French journal, Reseau Voltaire.net, wrote on the eve of the Iraq war that the dollar was ‘The achilles heel of the USA’. That is an understatement to put it mildly.

Iraq was planned long before

This emerging threat from a French-led Euro policy with Iraq and other countries, led some leading circles in the U.S. policy establishment to begin thinking of pre-empting threats to the Petro-dollar system well before Bush was even President. While Perle, Wolfowitz and other leading neo-conservatives played a leading role in developing a strategy to preserve the faltering system, a new consensus was shaping which included major elements of traditional Cold War establishment around figures like Rumsfeld and Cheney.

In September 2000, during the campaign, a small Washington think-tank, the Project for a New American Century, released a major policy study: ‘Rebuilding America’s Defenses: Strategies, Forces and Resources for a New Century’. The report is useful in many areas to better understand present Administration policy. On Iraq, it states, ‘The United States has sought for decades to play a more permanent role in Gulf regional security. While the unresolved conflict with Iraq provides the immediate justification, the need for a substantial American force presence in the Gulf transcends the issue of the regime of Saddam Hussein.’

This PNAC paper is the essential basis for the September 2002 Presidential White Paper, ‘The National Security Strategy of the United States of America’. The PNAC’s paper supportes a, ‘blueprint for maintaining global U.S. pre-eminence, precluding the rise of a great power rival, and shaping the international security order in line with American principles and interests The American Grand Strategy must be pursued as far into the future as possible.’ Further, the U.S. must, ‘discourage advanced industrial nations from challenging our leadership or even aspiring to a larger regional or global role.’ (emphasis added).

The PNAC membership in 2000 reads like a roster of the Bush Administration today. It included Cheney, his wife Lynne Cheney, neo-conservative Cheney aide, Lewis Libby; Donald Rumsfeld; Rumsfeld Deputy Secretary Paul Wolfowitz. It also included NSC Middle East head, Elliott Abrams; John Bolton of the State Department; Richard Perle, and William Kristol. As well, former Lockheed-Martin vice president, Bruce Jackson, and ex-CIA head James Woolsey were on board, along with Norman Podhoretz, another founding neo-con. Woolsey and Podhoretz speak openly of being in ‘World War IV’.

It is becoming increasingly clear to many that the war in Iraq is about preserving a bankrupt American Century model of global dominance. It is also clear that Iraq is not the end. What is not yet clear and must be openly debated around the world, is how to replace the failed Petro-dollar order with a just new system for global economic prosperity and security.

Now, as Iraq threatens to explode in internal chaos, it is important to rethink the entire postwar monetary order anew. The present French-German-Russian alliance to create a counterweight to the United States requires not merely a French-led version of the Petro-dollar system, some Petro-euro system, that continues the bankrupt American Century, only with a French accent, and euros replacing dollars. That would only continue to destroy living standards across the world, adding to human waste and soaring unemployment in industrial as well as developing nations. We must entirely rethink what began briefly with some economists during the 1998 Asia crisis, the basis of a new monetary system which supports human development, and does not destroy it.

|

il Empire

il Empire  IL...

IL... IL...

IL...