SPDR S&P500 ETF

28 prosinac 2018Preface

S&P500 drowned in last few days. Looks like we're ready to bounce. Are you ready to invest?

Blackmoon has solution for you!

The ETF assets in US have grown at a 34% annualized since 2000, bringing the current total to $3.4 trillion, according to James Ross, Chairman of the Global SPDR Business in State Street Global Advisors. Without a doubt such numbers indicate high popularity of ETFs among the investors. But what made this type of investments so attractive? And what stands behind the term “ETF”? Let’s start our journey from the beginning of ETF history and consider the SPDR S&P500 ETF, one of the largest ETFs in terms of AuM, in its context.

ETF Begins

The idea of index investing appeared more than 30 years ago. At that time only trusts and closed end funds tried to provide the investors with the opportunity to get exposure to one class of assets. According to “The Exchange-Traded Funds Manual” written by Gary Gastineau, the first kind of ETF was Index Participation Shares for the S&P 500 launched in 1989. However, the Federal Court of Chicago decided that the fund worked like future contracts and so should be traded on the futures exchange.

The date of establishment of the ETF vehicles is considered to be January 22, 1993 when State Street Global Advisors created SPDR S&P 500 ETF. It was the very first ETF, becoming the flagship for the exchange traded products and meaningfully impacted the modern investment landscape.

SPDR S&P500 ETF

The SPDR S&P500 ETF was designed to track the performance of the US large cap market equities included in S&P 500 index. So the purchase of shares of this ETF provides investors with the access to the US large cap space and also with the investment results corresponding to the price and yield of the S&P500 index. Let’s take a closer look at the underlying index.

Standard and Poor’s 500 (S&P 500®) is an American stock market index based on the market capitalization of 500 large companies having common stock listed on NYSE and NASDAQ. Created in 1957 the S&P 500 index was the first US market-cap-weighted stock index. One of the major characteristics which makes each index unique is its proprietary components selection model. The companies included in the S&P 500 are selected by the S&P Index Committee, a team of analysts and economists at Standard & Poor’s.

S&P designed several criteria for including the company in the index:

Universe. All constituents must be U.S. companies.

Eligibility Market Cap. Companies with market cap of USD 6.1 bn or greater.

Public Float. At least 50% of shares outstanding must be available for trading.

Financial Viability. Companies must have positive as-reported earnings over the most recent quarter, as well as over the most recent four quarters (summed together).

Adequate Liquidity and Reasonable Price. Consists of highly tradable common stocks, with active and deep markets.

The components of the index are reviewed quarterly in order to remain indicative of the US stock market (well, I even believe when the new company is included in the index, its management celebrates this event).

Thanks to its companies selection methodology, today S&P 500 index covers appr. 80% of available market capitalization and so is considered as one of the best representations of the US stock market.

Let’s return back to the SPDR S&P 500 ETF. This ETF holds the portfolio of common stocks that are included in the S&P 500 index, with the weight of each stock in the portfolio substantially corresponding to the weight of such stock in the S&P 500 index.

And what about investment returns?

The value of each unit in SPDR S&P500 ETF at any given time reflects the movement of the underlying index. So the objective of this fund is to generate the investment results corresponding to the returns of the index composed of the US 500 large cap market equities. As of March 23, 2018 returns were solid over the 1-Y, 3-Y and 5-Y period, with gains of 17.11%, 11.08% and 14.65%, respectively.

New horizons for the conventional vehicles

SPDR S&P 500 ETF is the best recognised and the oldest ETF which typically tops rankings for the largest asset under management and greatest trading volume. To sum it all up, the key benefits of SPDR S&P 500 ETF are:

Closely tracks the performance of the S&P 500 index;

The oldest of the S&P 500 benchmarked fund;

Ability to get a depth of the market exposure;

Provides an opportunity to diversify the portfolio;

Can be used as a hedging instrument;

Highly liquid.

Thanks to the success of SPDR S&P500 ETF derived from its key advantages, today the number and variety of ETFs allow its investors to get exposure to nearly each market asset class.

How do crypto investors may get exposure to such a popular instrument as ETF among traditional investors? The Blackmoon Platform provides a unique opportunity for a blockchain investor to access the performance of a liquid, conventional and diversified instrument as an ETF, gaining exposure to the US large cap space without leaving the Blockchain ecosystem. You may find more information regarding the SPDR S&P500 ETF and Blackmoon Platform here.

Prepared by Anastasia Rodina

platform website: https://blackmoonplatform.com;

telegram chat for the investors in asset tokens https://t.me/blackmoonplatform;

telegram chat for the BMC token holders https://t.me/blackmooncrypto.

Disclaimer: This article provides you with educational material only and was prepared by Blackmoon team for information purposes only. Cryptocurrency markets are unregulated and carry a high degree of risk, including risk of loss of entire investment. Only risk capital you can afford to lose. This post is not intended to be investment advice. Before deciding to invest, you should seek independent legal and professional advice.

komentiraj (0) * ispiši * #

WHERE’s MY 10X? Or how the life of crypto investors changed in 2018

26 prosinac 2018Made few bad investments and you're losing faith in crypto? Continue reading to learn few things so you could become more successful investor!

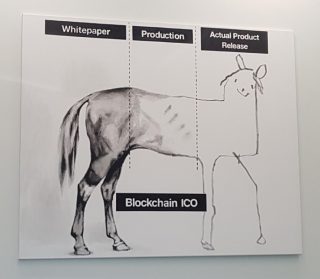

You have scrutinized a certain blockchain project, you have examined the whitepaper multiple times, you have checked all the team members, you have watched an overview of the project by your favorite blockchain vlogger, you have even joined project’s Slack channel, but still, no Moon. Why?

In this article, we are going to look at the main strategies of crypto investors in 2017 and 2018. We will try to understand how certain market characteristics and trends affected the success rate of these strategies. And finally, we will try to find out what to do in the current realities of the crypto industry.

Hindsight

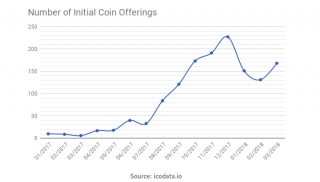

The tremendous success of the first ICOs has enchanted everybody: investors, projects seeking for crowdsale and scammers, of course. The number of ICOs has skyrocketed:

In the hunt for huge profits, crypto investors have been pouring billions of dollars into these crowdsales. For the majority of investors, the selection process literally consisted of checking the website, reading the whitepaper and maybe watching a couple of Youtube videos. That’s it! Funny enough this strategy did work just fine. Many investors thought they found new Klondike and bravely dived into this adventurous endeavor.

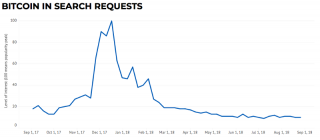

Why did it work? First, public awareness was rising very fast and the market was only preparing for the mission to the Moon.

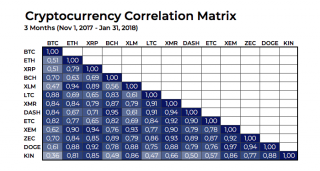

Second, when the market was on the rise, pretty much all more or less sensible projects were surging as well. In crypto, we have a highly correlated environment. Here are some stats:

The matrix shows that in the selected months the whole market was pretty much moving together. Even though it was a period of a high activity, we have been observing the same strong correlation throughout 2018.

Thereby, the success of many “crypto experts” was mainly attributable to the market situation.

What went wrong

In January 2018, the temporarily overbought crypto market reacted with a sharp correction. Keeping in mind the correlation matrix, this correction affected every project and also airlifted a big part of the crypto community back to reality.

The returns on ICO investments not only slowed down but also turned to negative. However, the market situation is not the only problem. The year 2018 is the year for many ICOs to roll out their products and as some part of them wrote their whitepapers from scratch, it turned out that, so far, not every project is able to build a relevant, secure and a properly functioning product.

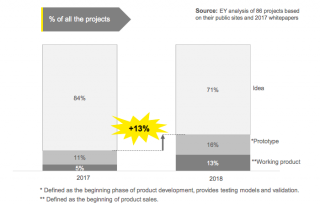

Recently, Earnst&Young published an update on their review of the top 141 ICO projects that in December 2017 accounted for 87% of funds invested in ICOs. In this follow-up study, they revisit the same group of projects to check the progress these companies have made. Here are the main points for our article:

86% of the projects are now below their listing price; 30% have lost substantially all value. An investor purchasing a portfolio of these 141 ICOs on 1 January 2018 would most likely have lost 66% of the investment.

Of the ICO start-ups, E&Y looked at, only 29% (25) have working products or prototypes, up by just 13% from the end of last year.

There were gains among selected projects, concentrated in 10 ICO tokens, most of which are in the blockchain infrastructure category.

There is also another statistic to support our point, it is the number of active addresses. As of October 22, only 26 projects have more than 500 active addresses in a 24-hour period.

This table shows that despite all the big words on websites and whitepapers a huge part of blockchain projects lack use cases and people just don’t use them, for now, they are mostly tools for speculation.

Consequences

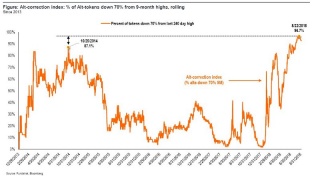

On September 6, 2018, Fundstrat Global posted an interesting statistic, called “Alt-correction index”. The chart below displays that on August 22, 2018, 96.7% of altcoins were down 70% and more from 9-month highs:

This shows that investors are leaving beloved ICOs and trying to find a safer place in the crypto world during this storm. Most of them try to move their funds to the top coins, but even these assets are experiencing some significant bearish tendencies. For instance, ETH has plummeted even tougher than BTC due to the overall trend in the ICO market.

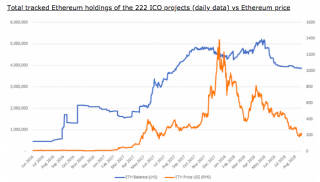

Recently BitMex published an interesting article named “Ethereum holdings in the ICO treasury accounts”, which is telling us about an economics behind of ICO funding and how these projects affect the price of ICO fuel

—

ether.

We see that this huge amount of ETH collected by ICO projects is downward pressuring the ETH price and till the majority of these projects won’t deliver products and get to the point when the operational profits will at least cover recurring costs, this situation will remain unstable.

Reaction from investors

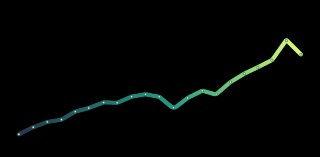

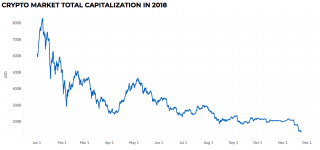

As a result, we have a huge number of investors moving away from altcoins. However, holding even the top cryptocurrencies in 2018 is an arduous business, not everyone can watch at one’s portfolio melting every day. BTC price chart is far from being as mesmerizing as it was in 2017:

Trading in the crypto world is highly inconvenient and, as we all know, it is the place where retail investors usually lose money. Quitting crypto completely is not an option too. First, it’s a tough moral choice to leave at these prices, and second, the market shows signs of consolidation, so no one wants to miss the next bull run.

So what are the most adequate options for investors right now?

What to do?

Here we have a list of the most sensible strategies that investors may employ:

A. To hold coins of those projects that have backed up their words with action. We need to appreciate these rare specimens with a working product.

B. To move funds to the very top coins and forget about them.

C. To use robots and algorithmic trading tools. As far as hodling in 2018 is not the sweetest thing, more and more investors turn to active strategies.

Apparently, a wise move will be to mix these options and build a portfolio of strategies fitting your investment preferences. While with points A and B it is possible to do everything on your own, with the point C, technically speaking, not everyone can build a home-made trading robot. Thus it is much easier to use a readily available solution.

Blackmoon’s solution

To start with, we are the only operational blockchain investment platform. Yes, we are one of those projects with a product.

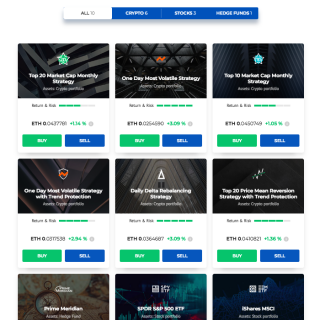

Today, we offer ten investment opportunities, six of them related to algorithmic crypto trading.

For those investors bullish on the crypto market’s future, we have an option to just index the market with our BMxT10 and BMxT20 tokens, which represent the top coins by market cap and are automatically rebalanced monthly.

For those looking for more active strategies, we currently have another 4 products. For example, BMxVTP token follows the performance of the most volatile coins, features trend protection mechanism to reduce downside risk and is rebalanced daily.

Finally, we have unprecedented for crypto industry products represented by tokens that follow the performance of assets from the world of traditional investments. It brings diversification of your crypto portfolio to a whole new level and lets you get exposure to traditional assets without leaving the crypto.

With these options already, investors can make a huge number of combinations for different risk/reward preferences. However, we are not content with these achievements and will continue to establish new standards in the field by constantly developing our product. Furthermore, we try to make our services available in as many countries as possible. Recently, we have opened our doors for US citizens, now accredited investors have an access to the investment opportunities on our platform.

Stay tuned for further updates as new options will be appearing in all of our product lines!

For more information: https://blackmoonplatform.com/showcase

Summary

First of all, it is impossible to make a solid investment decision based only on the website and the whitepaper. With such a small percent of projects with a working product, it is much safer to wait for some kind of an MVP and only then make final research and decision.

Second, the market conditions have changed dramatically, some of the working strategies are not relevant anymore. However, the market shows signs of consolidation, and despite bearish tendencies in 2018, the industry is still very promising.

Third, in current circumstances, investors are looking for new solutions, innovative investment products and various combinations of those. Some of the most appealing opportunities are trading robots and algorithmic solutions. These options are already available for investors around the globe.

We hope that this article will help our readers to navigate themselves in the current realities of the blockchain industry and will prevent them from possible risky or unreasonable decisions. Take care!

Handy links to stay tuned to our updates:

website: blackmoonplatform.com

telegram chat: https://t.me/blackmoonplatform

info video: https://youtu.be/6Ii0XckQOAE

DISCLAIMER

Investment in cryptocurrencies carries a high degree of risk and volatility and is not suitable for every investor; therefore, you should not risk the capital you cannot afford to lose. Please consult an independent professional financial or legal advisor to ensure the product meets your objectives before you decide to invest. Regional restrictions and suitability checks apply.

komentiraj (0) * ispiši * #

Click. Invest. Trade. They do the rest. New convenient layout released by Blackmoon platform

Hey, Blackmoon did some pretty awesome stuff with their website. It's redesigned and investing in Blackmoon's funds was never easier. You can check it and see for yourself!

Investor experience and convenience are paramount for Blackmoon. To better serve our clients, we released a new layout of the website. With this layout, investors can easily see available assets, their performance and buy/sell without leaving the main page.

Here is a screenshot of the new layout:

New Showcase Layout

“It has never been easier to pick an investment for my portfolio”

“You guys are doing an amazing job in design and UX”

“Nice and easy!”

These are the comments that we received from the first users. Although we must admit that some comments were like this one:

“Now I finally get what Blackmoon is doing!”

Summary of changes:

Showcase of the investment products on the front page.

More relevant information on the product cards.

Buy and sell buttons added to the product cards.

As before, a click on a card opens the product page with in-depth information.

Visit platform yourself at blackmoonplatform.com and send your feedback in live chat or post a comment to this article. Your feedback helps us to serve you better and deliver you the easy access to trade innovative investment products.

Handy links to stay tuned to our updates:

website: blackmoonplatform.com

telegram chat: https://t.me/blackmooncryptochannel

info video: https://youtu.be/6Ii0XckQOAE

DISCLAIMER

Investment in crypto currencies carries a high degree of risk and volatility and is not suitable for every investor; therefore, you should not risk the capital you cannot afford to lose. Please consult an independent professional financial or legal adviser to ensure the product meets your objectives before you decide to invest. Regional restrictions and suitability checks apply.

komentiraj (0) * ispiši * #

Navigating and Surviving the Crypto Storm

2018 bear market has been really rough. With bubble pop and cryptocurrencies down over 90% since all time high really shook the market. Don't want to lose more or wait long time to recover?

Blackmoon has wide variety of crypto strategies!

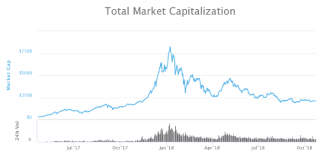

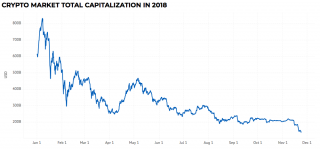

There has been a storm raining down on the crypto world over the past month. Total cryptocurrency market capitalization hit $120 billion on November 25, 2018. It has never been that low since September 2017. The market lost $40 billion in just 7 days. All in all, total cryptocurrency market showed -41% change over the last month, Bitcoin lost 42% of its value, ETH dived the most losing 47% and approaching $100. In fact, things are so wild at the moment that by the time we publish this article this data will most definitely change.

How can one navigate this storm and preserve one’s wealth when the market situation changes so fast? One option is to abandon the falling market, sell all cryptocurrency and wait for recovery. But doing so you may be stuck in a queue of hundreds of users who came up with the same decision. Moreover, the cost of this operation may skyrocket. Time and transaction costs may make the loss in value devastating under the condition of the consistent downtrend.

We, at Blackmoon, have developed an innovative investment opportunity that would keep your funds safe while the crypto market storm continues its fall. This option is called “Trend Protection” and works fairly easy at a first glance. Each day, an automated system evaluates the market direction and allocates available funds between crypto assets and cash (or cash equivalent that are represented by USD-pegged cryptocurrencies). The larger the part of the market is falling

—

the larger the part of the portfolio will be transferred to cash.

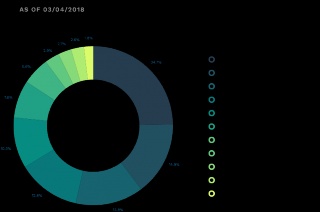

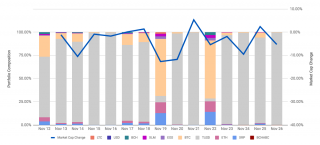

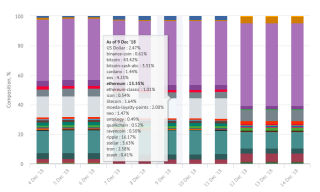

The graph below closely shows the structure of BMxDDR portfolio, over the recent most volatile days. The asset token tracks 6 cryptocurrencies with maximum capitalization and is equipped with the trend protection mechanism.

It’s easy to see that every time market capitalization decreases, TrueUSD occupies the portfolio. The larger the downside

—

the higher is TUSD allocation. Two days of positive correction, 18 and 21 November led to the unique events when the share of TUSD in the portfolio fell below 10% the next day after correction.

That is a very high-level logic of the trend protection feature. But what does it bring to the investor? Will it actually protect money from the downtrend, or will it only eat transaction costs that will wash out any possible benefits of relocation?

Blackmoon offers a wide range of crypto strategies. Some of them are featured with trend protection, some not. To compare apples to apples let’s take a look at how the similar strategies behave.

BMxT10, BMxT20 and BMxDDR all base portfolios on cryptocurrencies with the largest capitalization. They may differ by the number of coins included, portfolio rebalance periods and some other parameters, but generally, they focus on the same rule: the larger the coin, the larger the part of the portfolio it will occupy. The key difference is that BMxDDR employs trend protection mechanism. The left graph above shows that this feature allows the protected strategy to outperform rivals by nearly 40% in ETH within 1 month.

The same is true for another pair of strategies: BMx1DV and BMxVTP. Both of them focus on the coins with the highest volatility, but VTP is equipped by trend protection. The difference in returns of these strategies reaches a stunning 70%!

The table below shows USD returns of all our crypto strategies over 1-week and 1-month periods and compares them with BTC, ETH and overall market capitalization. Strategies that do not utilize trend protection feature show return around the market, while strategies with trend protection are way ahead.

Having these tokens in your portfolio will not allow you to grow your USD wealth because the crypto market does not offer investors solid ways to earn on the falling market these days, but you will definitely beat overall market. Moreover, these strategies are fully automated and will do all the work for you

—

all you have to do is click, invest and trade.

Feel free to utilize the full potential of the trend protected assets while the market is all red.

Do you want to find out other ways to survive and benefit any market situation? Stay with us, register your account on blackmoonplatform.com and keep an eye on new products that are coming soon.

Handy links to stay tuned to our updates:

website: blackmoonplatform.com

telegram channel: https://t.me/blackmooncryptochannel

info video: https://youtu.be/6Ii0XckQOAE

DISCLAIMER

Investment in cryptocurrencies carries high degree of risk and volatility and is not suitable for every investor; therefore, you should not risk the capital you cannot afford to lose. Please consult an independent professional financial or legal advisor to ensure the product meets your objectives before you decide to invest. Regional restrictions and suitability checks apply.

komentiraj (0) * ispiši * #

SPDR S&P500 ETF

25 prosinac 2018Preface

The ETF assets in US have grown at a 34% annualized since 2000, bringing the current total to $3.4 trillion, according to James Ross, Chairman of the Global SPDR Business in State Street Global Advisors. Without a doubt such numbers indicate high popularity of ETFs among the investors. But what made this type of investments so attractive? And what stands behind the term “ETF”? Let’s start our journey from the beginning of ETF history and consider the SPDR S&P500 ETF, one of the largest ETFs in terms of AuM, in its context.

ETF Begins

The idea of index investing appeared more than 30 years ago. At that time only trusts and closed end funds tried to provide the investors with the opportunity to get exposure to one class of assets. According to “The Exchange-Traded Funds Manual” written by Gary Gastineau, the first kind of ETF was Index Participation Shares for the S&P 500 launched in 1989. However, the Federal Court of Chicago decided that the fund worked like future contracts and so should be traded on the futures exchange.

The date of establishment of the ETF vehicles is considered to be January 22, 1993 when State Street Global Advisors created SPDR S&P 500 ETF. It was the very first ETF, becoming the flagship for the exchange traded products and meaningfully impacted the modern investment landscape.

SPDR S&P500 ETF

The SPDR S&P500 ETF was designed to track the performance of the US large cap market equities included in S&P 500 index. So the purchase of shares of this ETF provides investors with the access to the US large cap space and also with the investment results corresponding to the price and yield of the S&P500 index. Let’s take a closer look at the underlying index.

Standard and Poor’s 500 (S&P 500®) is an American stock market index based on the market capitalization of 500 large companies having common stock listed on NYSE and NASDAQ. Created in 1957 the S&P 500 index was the first US market-cap-weighted stock index. One of the major characteristics which makes each index unique is its proprietary components selection model. The companies included in the S&P 500 are selected by the S&P Index Committee, a team of analysts and economists at Standard & Poor’s.

S&P designed several criteria for including the company in the index:

Universe. All constituents must be U.S. companies.

Eligibility Market Cap. Companies with market cap of USD 6.1 bn or greater.

Public Float. At least 50% of shares outstanding must be available for trading.

Financial Viability. Companies must have positive as-reported earnings over the most recent quarter, as well as over the most recent four quarters (summed together).

Adequate Liquidity and Reasonable Price. Consists of highly tradable common stocks, with active and deep markets.

The components of the index are reviewed quarterly in order to remain indicative of the US stock market (well, I even believe when the new company is included in the index, its management celebrates this event).

Thanks to its companies selection methodology, today S&P 500 index covers appr. 80% of available market capitalization and so is considered as one of the best representations of the US stock market.

Let’s return back to the SPDR S&P 500 ETF. This ETF holds the portfolio of common stocks that are included in the S&P 500 index, with the weight of each stock in the portfolio substantially corresponding to the weight of such stock in the S&P 500 index.

And what about investment returns?

The value of each unit in SPDR S&P500 ETF at any given time reflects the movement of the underlying index. So the objective of this fund is to generate the investment results corresponding to the returns of the index composed of the US 500 large cap market equities. As of March 23, 2018 returns were solid over the 1-Y, 3-Y and 5-Y period, with gains of 17.11%, 11.08% and 14.65%, respectively.

New horizons for the conventional vehicles

SPDR S&P 500 ETF is the best recognised and the oldest ETF which typically tops rankings for the largest asset under management and greatest trading volume. To sum it all up, the key benefits of SPDR S&P 500 ETF are:

Closely tracks the performance of the S&P 500 index;

The oldest of the S&P 500 benchmarked fund;

Ability to get a depth of the market exposure;

Provides an opportunity to diversify the portfolio;

Can be used as a hedging instrument;

Highly liquid.

Thanks to the success of SPDR S&P500 ETF derived from its key advantages, today the number and variety of ETFs allow its investors to get exposure to nearly each market asset class.

How do crypto investors may get exposure to such a popular instrument as ETF among traditional investors? The Blackmoon Platform provides a unique opportunity for a blockchain investor to access the performance of a liquid, conventional and diversified instrument as an ETF, gaining exposure to the US large cap space without leaving the Blockchain ecosystem. You may find more information regarding the SPDR S&P500 ETF and Blackmoon Platform here.

Prepared by Anastasia Rodina

platform website: https://blackmoonplatform.com;

telegram chat for the investors in asset tokens https://t.me/blackmoonplatform;

telegram chat for the BMC token holders https://t.me/blackmooncrypto.

Disclaimer: This article provides you with educational material only and was prepared by Blackmoon team for information purposes only. Cryptocurrency markets are unregulated and carry a high degree of risk, including risk of loss of entire investment. Only risk capital you can afford to lose. This post is not intended to be investment advice. Before deciding to invest, you should seek independent legal and professional advice.

komentiraj (0) * ispiši * #

Continuous Contributor Programme Launched!

For many it’s been a long wait, and today we proudly deliver another promise to our BMC community.

Ladies and gentlemen, the Continuous Contributor (CC) programme beta is now available for eligible BMC token holders on the Blackmoon Platform. And there is more! We have enhanced the programmes mechanism to offer an even easier user experience that will allow you to contribute to the success of the community, and in the process earn rewards by actively promoting predefined content with your network.

Now CC beta participants will be able to participate in missions that are complied of tasks which in its core will do what the programme aimed from the start

—

adding value to the platform and the investment opportunities it provides. Participants can access the Programme by logging into the Blackmoon Platform and clicking on “Partnership”.

In the beta version of the programme, all tasks will include different activity related to promoting predetermined content in today’s most popular social media channels such as facebook, twitter and medium among others. All predetermined content material will be provided by our marketing team to ensure that all promoted content is compliant, insightful and most important relevant to the target audience. In a nutshell, we provide the content and you spread the word in your network. Just like the tokens available on our platform, the tasks within the mission are designed to attract a wide range of potential crypto investors.

The Reward System

As CCs beta participants start getting into their mission and completing tasks, points will be awarded to their accounts. These points will be used to calculate the contribution of each participant and will be used to define the overall / total Mission reward distribution between all CCs that have applied to participate in particular mission.

In other words, points will be used to reflect the “weight” of the activity among all participating users. All points are varied by the given tasks. The overall reward will be distributed between CC after each given mission period. Mission Period is a time frame within which the Mission are accumulating and at the end of which reward shall be calculated and distributed. For now the Mission Period is set to be a calendar month. See the formula below.

Reporting of completed task for participants will be as simple as participating in the programmes mission.

Copy and share with your friends

Send us the link to the item you shared

Watch your points grow!

To ensure a fair and transparent environment our team of managers have been carefully instructed to ensure that all those involved are rewarded accordingly to the Mission rules and regulations.

Can’t wait to start? It’s simple. All you need is to register via our website and verify your account. By internal compliance policies and for the safety of the programme this is a mandatory procedure that should not take more than 5 to 10 minutes of your time. For those participants who have already been verified all you will need to do is apply for the Mission in your personal account area.

For our team, it’s a great pleasure to provide you with all information that you may need to enjoy this long awaited experience. We want to make the Continuous Contributor Programme fun, easy and financially rewarding as possible.

Enjoy and Good luck!

Handy links to stay tuned to our updates:

website: blackmoonplatform.com

telegram chat: https://t.me/blackmoonplatform

info video: https://youtu.be/6Ii0XckQOAE

DISCLAIMER

Investment in cryptocurrencies carries high degree of risk and volatility and is not suitable for every investor; therefore, you should not risk the capital you cannot afford to lose. Please consult an independent professional financial or legal advisor to ensure the product meets your objectives before you decide to invest. Regional restrictions and suitability checks apply.

komentiraj (0) * ispiši * #

Xiaomi IPO. How to invest with crypto?

Xiaomi, the largest Chinese smartphone company, is set for a blockbuster $10 billion IPO this July according to Reuters. What does this have to do with blockchain? The answer is simple, now, crypto investors also have an opportunity to ride the wave of the performance of the Xiaomi shares on the Hong Kong stock exchange thanks to the Blackmoon platform.

Blackmoon launches the token sale of the BMxXMI asset token. This asset token offers a unique opportunity for crypto investors to get exposure to the Xiaomi Corporation shares starting right from the IPO date. The proceeds of the token sale will be transferred to the Broker to apply for a share allocation at IPO.

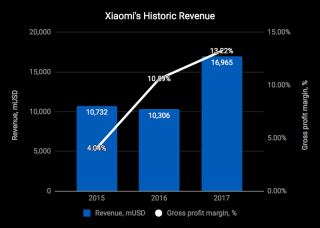

It took just seven years for Xiaomi to become world’s fourth largest smartphone company with $17 billion revenue in 2017 and 13% gross profit margin.

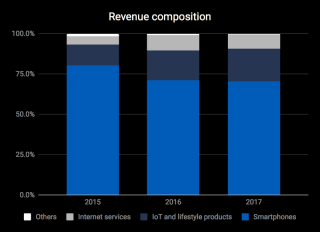

Xiaomi started with smartphones and diversified its business to wearable devices, IoT, laptops, mobile applications and other consumer electronics and computer hardware.

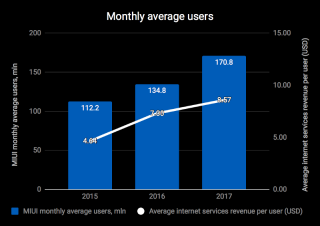

As of the March 31, 2018 the company is represented in 74 countries and has over 190 million active users.

Interested to learn more information on Xiaomi and to participate in the BMxXMI token sale before the IPO? Register at Blackmoon platform to get access to diversified investment opportunities.

Handy links to stay tuned to our updates:

website: blackmoonplatform.com

showcase of tokens: https://blackmoonplatform.com/showcase

Info video: https://youtu.be/6Ii0XckQOAE

YouTube channel:https://www.youtube.com/c/blackmoonplatform

DISCLAIMER

Investment in cryptocurrencies carries high degree of risk and volatility and is not suitable for every investor; therefore, you should not risk the capital you cannot afford to lose. Please consult an independent professional financial or legal advisor to ensure the product meets your objectives before you decide to invest. Regional restrictions and suitability checks apply.

komentiraj (0) * ispiši * #

$2 trillion US industry tokenized on Blackmoon

24 prosinac 2018Want to invest in traditional assets? Want to reduce your risk and still have opportunity for profit?

Blackmoon has solution for you!

Tokenizing assets is the future of investing. You can tokenize anything, be legal and compliant, and still buy from comfort of your own home without any middleman. You invest direct on Blackmoon platform.

Prime Meridian Real Estate Lending fund. Blackmoon offers access to US high yield marketplace lending fund.

Building on the recent successful launch of their three crypto strategies that outperform major cryptocurrencies, Blackmoon now offers a tokenized version of a leading US hedge fund.

Prime Meridian Capital Management is an SEC-registered investment advisor founded in 2012 with $700 million in assets under management. It was named “Top Fund Manager” at LendIt USA Awards 2017 and ranked #554 by Inc. Magazine on its annual Inc. 5000 the same year.

The BMxPMR token offered on the platform gives exposure to the performance of the Prime Meridian Real Estate Lending fund. This fund is the fastest growing across four funds established by Prime Meridian Capital Management. Its assets under management grew more than 100 times since inception in 2016. And every month the fund has delivered positive returns to the investors.

The fund invests in a $2.0 trillion private real estate lending market. The portfolio consists of the short duration, high-yield loans secured by the US real estate. The loans are issued by the leading US loan origination platforms. These platforms apply rigorous scoring and checks to its clients.

To provide investors with additional security and to enhance returns Prime Meridian Capital Management applies its own scoring. The automated algorithm selects loans with the best expected risk and return profile. This approach helps Prime Meridian to consistently outperform peers and win prestigious rewards like “Top Fund Manager” at LendIt USA.

Have you ever wanted to invest in the real estate lending market but didn’t have 100,000’s of dollars to do so? With a low minimum investment, you can invest in a secure real estate fund in just a few clicks on the Blackmoon platform. BMxPMR token gives you access to the performance of the successfully implemented investment strategy, professionally managed by one of the most experienced teams in the industry.

Detailed information is available exclusively to the verified users of the platform. Complete your KYC now to get access to this and other opportunities on Blackmoon.

Handy links to stay tuned to our updates:

website: https://blackmoonplatform.com

telegram chat: https://t.me/blackmoonplatform

info video: https://youtu.be/6Ii0XckQOAE

DISCLAIMER

Investment in cryptocurrencies carries high degree of risk and volatility and is not suitable for every investor; therefore, you should not risk the capital you cannot afford to lose. Please consult an independent professional financial or legal advisor to ensure the product meets your objectives before you decide to invest. Regional restrictions and suitability checks apply.

komentiraj (0) * ispiši * #

The time of algorithmic crypto trading has come

Don't know anything about trading, but still want to be a part of the "market"?

Are you tired of spending nights in front of your computer and making wrong decisions?

Blackmoon has solution for you!

“95% of all traders fail” is a widely known statistic and at the same time a forgotten facet of traditional trading. This has been a long-standing problem. Many individuals, instead of actively trading, choose to index the market or turn to algorithmic trading.

But how does this number look like in the realm of crypto trading? While there are many factors contributing to this fail rate, commonly lack of professionalism or psychology, the specificity of the crypto universe takes it to the whole new level.

In this article we review fundamental problems in crypto trading and propose solutions when the game is rigged.

POSITIVE OUTLOOK

You may say that nowadays the crypto market is highly inefficient, offers many opportunities and endlessly appealing for the sharks and whales hungry for the big scoops and tasty tidbits in the faces of average crypto traders. And you will be right. However, not only understanding of your position in this food chain matters, but also the economic viability of the time and energy spent on beating the market.

THE CHALLENGE

Let us now switch to the obstacles that, in our case, can turn 95 percent into 99. We will break it down into 4 categories each representing major headaches of the crypto traders:

Crypto trading peculiarities

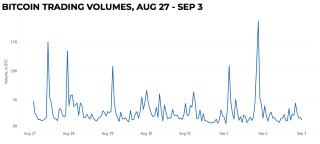

Absence of trading sessions, or 24/7 trading, causes substantial inconvenience to everyone. Certain individuals are taking shifts with their teammates, while the others are setting price alerts that will wake them at midnight to take the necessary action. We plotted hourly data of Bitcoin trading volumes to show you that there is no constant periodicity and the volume explosions may occur at any time throughout the day and night.

Security and technical complexity

Have you ever heard this story about some random guy losing a significant amount of bitcoins along with his old hard drive? We can only imagine the number of digital coins buried under piles of iron. !ombined with the stolen funds during the cybercrime activities and the coins that were lost because of an error in the recipient address, it sums up to real money

On top of that, crypto trading tools, including trading terminals and exchanges, are far behind their counterparts from the traditional world. Today, on Coinmarketcap we have a list of 219 exchanges, and if you choose one, you do it at your own risk.

Lack of transparency of the crypto-related projects

Oh, dear reader, you have, probably, many times been faced with this problem when you spend about 30 minutes on yet another “disrupting the industry” company’s website and you have no clue regarding what they actually do and is there a working product or not. That is why even the most patient and deliberate investor may be subjected to the irregularity of the industry.

Market manipulations

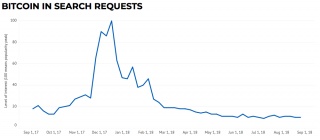

At a certain stage of development every crypto trader was in a pump & dump group chat. However, it is only a drop in the ocean as main actors on the stage are “whales” who time after time taking an advantage of less-knowledgeable investors by drawing whatever price movement they want. The chart below shows how the price manipulation has sharply risen the interest in the public, and we all know the end of this story.

SO THE GAME IS RIGGED, SHOULD I QUIT?

Not really. Some companies rose to this challenge and the Blackmoon Platform already has solutions for different types of traders

—

Crypto Strategies powered by algorithmic trading. The strategies are deliberately prepared by our Data Science team and are fully automated.

Let us walk you through the major types of traders and existing solutions:

“HODLERS” and Position Traders

These individuals do believe in the bright future of the blockchain, hold their coins from months to years and do not depend much on potentially misleading news and temporal price swings.

Solution: Blackmoon’s Top 20 Market Cap Crypto Strategy

The strategy lets you get the market exposure by buying just one token which is the asset token of the strategy tracking coins with the largest market capitalization in the previous three-month period. The core objective of the strategy is to generate the returns corresponding to the yield of the cryptocurrencies with the largest capitalization.

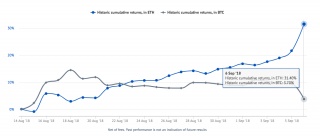

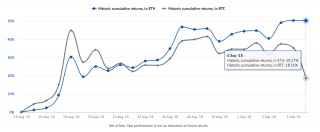

In just three weeks, the strategy has already shown solid performance in USD (+14.5%) and continues to outperform the market yielding a remarkable return of 31.4% in ETH and 3.7% in BTC!

Day Traders and Action Chasers

If you hold your coins no longer than day or two and you are obsessed by huge price movements, possibly, you belong to this category.

Solution: Blackmoon’s One Day Most Volatile Crypto Strategy

One Day Most Volatile Strategy token is the asset token of the strategy tracking the cryptocurrencies that have had the largest volatility in the previous 24 hours. The objective of this strategy is to generate the returns corresponding to the yield of the crypto assets with the largest volatility.

In just three weeks, outstanding results of this strategy are marked the +30.9% return in USD and yielding stunning returns in ETH(+50.2%) and BTC(+18.5%)!

Swing or Trend Traders

These individuals open their positions, sometimes gradually, at what they calculate to be the local bottom, then they hold the position all the way to what they believe to be the local top, most of the times gradually scaling out of the position to lock in profits. Swing trading is generally done over the course of days or weeks.

Solution: Blackmoon’s Daily Delta Rebalancing Crypto Strategy

Daily Delta Rebalancing token is the asset token of the strategy focusing on delivering alpha to ETH by adjusting the basket of the top 6 market-cap of coins and cash. The core objective of the strategy is to generate the returns corresponding to the yield of the top 6 cryptocurrencies with the largest capitalization providing downside risk protection by dynamically allocating portfolio between cash and crypto.

While the strategy currently falls behind the other two, it left the “red zone” and shows what it was created for by outperforming ETH even when the market plummets.

For more information: https://blackmoonplatform.com/showcase/ddr/aboutase/ddr/about

CONCLUSION

There is a belief that selling is backward-looking and buying is forward-looking. Investors buy coins because of their expectations and sell them because of what has already happened. In most cases, this leads the majority of investors selling winners and holding losers. In addition, many retail investors do not stand up to the psychological pressure of the crypto market with all these price swings of unimaginable scale.

Machines, in turn, do not sleep, nor do they tremble before unexpected price movements. They just automatically execute the predefined algorithm and do it cost efficiently.

So is it worth trying to hit these 5% of winning traders? Or it is better to save you time, energy and nerves by using algorithmic trading and investing in fitting your goals and personality set of strategies?

You should do you own research and weigh all the pros and cons before making the decision. On our side, we will keep the pace and introduce new crypto strategies in the nearest future. Stay tuned for further updates in the investment opportunities on our platform!

Handy links to stay tuned to our updates:

website: https://blackmoonplatform.com

telegram chat: https://t.me/blackmoonplatform

info video: https://youtu.be/6Ii0XckQOAE

YouTube Channel: https://www.youtube.com/blackmoonplatform

parent company website: https://blackmoonfg.com

DISCLAIMER

This article provides you with educational material only and was prepared by Blackmoon team for information purposes only. Cryptocurrency markets are unregulated and carry a high degree of risk, including a risk of loss of entire investment. Only risk capital you can afford to lose.

Past performance does not guarantee future results. Trading history presented is less than 5 years and may not suffice as basis for investment decision. This post is not intended to be investment advice. Before deciding to invest, you should seek independent legal and professional advice.

komentiraj (0) * ispiši * #

Blackmoon INVERSE ETH (BMxiETH) strategy

In last 2 days Ethereum had strong pumps and jumped in value both in USD and BTC. Is it time to "short"? want to earn if it starts falling?

Blackmoon has solution for you! Inverese Ethereum strategy. When ethereum falls, you earn!

The strategy seeks to generate returns opposite to the performance of ETH. It provides investors with positive returns when ETH goes down and negative returns when ETH goes up.

The catastrophic lack of investment tools in the crypto world makes this product a unique and a one-of-a-kind opportunity to capitalize on market downturns and to diversify your arsenal of investment strategies.

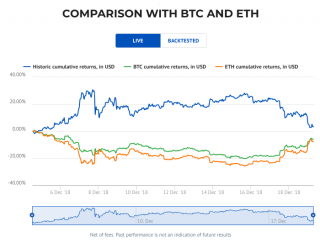

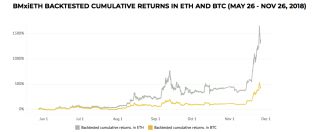

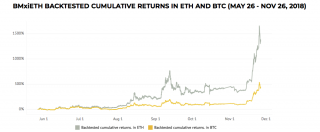

Of course, it is a short-term investment tool, which makes it possible to be proactive during bad times in the crypto market instead of depressingly waiting until the storm is over. During less than two weeks since the launch of the product, our investors had a chance of taking advantage of the recent price drop in the market. Here you can see live results:

The strategy returns in ETH and BTC are expectedly much more volatile peaking at +73% and +61% respectively.

We provide our investors with innovative investment tools; on your side, you should undertake an in-depth analysis and adhere to a sensible strategy since market timing is crucial in products like Inverse ETH.

For more information: https://blackmoonplatform.com/showcase/ieth/about

website: blackmoonplatform.com

telegram channel: https://t.me/blackmooncryptochannel

info video: https://youtu.be/6Ii0XckQOAE

DISCLAIMER

Investment in crypto currencies carries a high degree of risk and volatility and is not suitable for every investor; therefore, you should not risk the capital you cannot afford to lose. Please consult an independent professional financial or legal adviser to ensure the product meets your objectives before you decide to invest. Regional restrictions and suitability checks apply.

Oznake: kriptovalute

komentiraj (0) * ispiši * #

Blackmoon - Monthly Digest : December 2018

23 prosinac 2018Introduction

Ladies and gentlemen, we have a winner!

We start off this monthly digest with the announcement of the winner of our first Continuous Contributors contest

—

Mission 1: Light Moon. System tested, marketing objectives achieved, generous awards and prizes paid!

Here is a quote from the winner:

“I saw my rewards and of course, I was very happy. First of all, I would like to express my gratitude to the Team for fundamentally accurate fulfilment of the mission reward conditions. For me, it was very important, because in the crypto sphere today, such an approach is not a standard.”

- Artyom Korovkin, Blackmoon’s CC.

I was placed on number 4 on leaderboard at the end of the first round, and got my portion of BMC tokens. It was really nice portion,and it's really nice to see team sticking to the philosophy they're talking for a year now. It's real,and it's fully transparent.

Round 2 is already in motion, so please use this opportunity to promote Blackmoon and earn coins for your effort.

After this successful launch and completion of the first stage, we are pleased to announce that the Blackmoon team has decided to continue testing the Beta of the Continuous Contributor programme. We received some recommendations for improvement and we have taken them into account and improved the programme. Now, we encourage you to participate in the continuation of the first mission: MISSION 1: LIGHT MOON

—

2. The rules remain the same.

We have also released some new innovative investment opportunities

—

the Binance Most Traded and the Inverse ETH (more about that below) which brings the total amount of investment strategies to 12!

Platform Developments

We provided our users with a very attractive opportunity

—

now you may start investing immediately after passing registration!

In order to take advantage of Blackmoon’s investment strategies, you should follow the simple steps below:

1. Login to Blackmoon

2.Start investing with some limitations

3. Verify your profile by answering some questions and uploading your Proof of Identity and Proof of Residence document

4. Invest with no limitations

If you have any questions regarding your account or what to do next, you can contact our customer support team.

New Products Released

In December we rolled out two new products breaking new ground in the crypto world.

BINANCE MOST TRADED (BMxBN20)

The exchange-traded index is linked to the performance of the 20 coins with the largest trading volume on Binance.

The index, which can be bought or sold on our platform, automatically tracks the trading volume of the coins that gained most interest on the largest crypto exchange and rebalances the portfolio of the underlying coins on a weekly basis.

On the Blackmoon platform, you can check the composition of this portfolio for each date:

The product creates arbitrage opportunities for crypto investors while adding liquidity for individual assets.

For more information: https://blackmoonplatform.com/showcase/bn20/about

INVERSE ETH (BMxiETH)

The strategy seeks to generate returns opposite to the performance of ETH. It provides investors with positive returns when ETH goes down and negative returns when ETH goes up.

The catastrophic lack of investment tools in the crypto world makes this product a unique and a one-of-a-kind opportunity to capitalize on market downturns and to diversify your arsenal of investment strategies.

Of course, it is a short-term investment tool, which makes it possible to be proactive during bad times in the crypto market instead of depressingly waiting until the storm is over. During less than two weeks since the launch of the product, our investors had a chance of taking advantage of the recent price drop in the market. Here you can see live results:

The strategy returns in ETH and BTC are expectedly much more volatile peaking at +73% and +61% respectively.

We provide our investors with innovative investment tools; on your side, you should undertake an in-depth analysis and adhere to a sensible strategy since market timing is crucial in products like Inverse ETH.

For more information: https://blackmoonplatform.com/showcase/ieth/about

Company News

In this fast-moving market, it’s important to be able to quickly take advantage of market movements without any delay. A delay may result in a missed opportunity. This is why we have implemented a feature which allows investors to start investing immediately upon signing up.

We published two articles that were well received by readers. The first one is very relevant for the current bearish market “Navigating and Surviving the Crypto Storm”. The article covers how one could preserve one’s wealth when the market situation changes so fast. The other article, “Who owns Blockchain: FinTech Blockchain-related patent ownership breakdown” covers blockchain intellectual property rights and lists some of the owners of the technologies that we have all become very familiar with. Head over to our Medium news page to read these and other interesting articles.

We have also released a new sidebar menu on our investor’s dashboard. This small but effective improvement allows the client to better navigate the Platform and streamline their daily activities.

Conferences

Moscow meetup

We decided to hold our first meetup in Moscow in early November. The event was in the centre of Moscow in a homely atmosphere. Sergey Vasin and Konstantin Obuhov talked about the current and innovative solutions in the crypto market at the end of 2018, and how we solve the problems faced by private investors in the crypto world.

You can view the video here (Russian language).

Media Mentions

We had very important news last month in that we launched a new asset token

—

Binance ETx which is linked to the performance of the most-traded coins on Binance. For more details about it you can read here.

Also, you can learn about us by reading our articles on medium:

Navigating and Surviving the Crypto Storm

Who owns Blockchain: FinTech Blockchain-related patent ownership breakdown

WANT TO CAPITALIZE ON CRYPTO MARKET DECLINES? The first of its kind

—

The Inverse ETH Strategy by Blackmoon

The Year Ahead

Since this is the last Monthly Digest of 2018, we wanted to give you a general idea of what’s in store for 2019.

As you already know, we constantly release new investment opportunities that are segmented in various categories namely Crypto (8 products), Stocks (3 products) and Hedge Funds (1 product). However, you will start to see more categories of strategies being introduced such as Thematic Portfolios, Exchange Traded Indexes (ETx) and more. These categories will be populated with even more of our innovative investment opportunities.

You can see these items and a few more by visiting our roadmap.

To end off, we would like to say that we hope that this Holiday Season finds you and your families well and in good spirits. May all of your wishes and dreams come true and may you have happiness (and profits!) in the New Year that’s coming.

Like this article? Give it a Clap!

Like Blackmoon? Follow us!

website: blackmoonplatform.com

telegram channel: https://t.me/blackmooncryptochannel

info video: https://youtu.be/6Ii0XckQOAE

DISCLAIMER

Investment in crypto currencies carries a high degree of risk and volatility and is not suitable for every investor; therefore, you should not risk the capital you cannot afford to lose. Please consult an independent professional financial or legal adviser to ensure the product meets your objectives before you decide to invest. Regional restrictions and suitability checks apply.

komentiraj (0) * ispiši * #

WHERE’s MY 10X? Or how the life of crypto investors changed in 2018

We've been in really bad bear market in 2018. With all the possitive news, where are the prices? where is your 10x?

You have scrutinized a certain blockchain project, you have examined the whitepaper multiple times, you have checked all the team members, you have watched an overview of the project by your favorite blockchain vlogger, you have even joined project’s Slack channel, but still, no Moon. Why?

In this article, we are going to look at the main strategies of crypto investors in 2017 and 2018. We will try to understand how certain market characteristics and trends affected the success rate of these strategies. And finally, we will try to find out what to do in the current realities of the crypto industry.

Hindsight

The tremendous success of the first ICOs has enchanted everybody: investors, projects seeking for crowdsale and scammers, of course. The number of ICOs has skyrocketed:

In the hunt for huge profits, crypto investors have been pouring billions of dollars into these crowdsales. For the majority of investors, the selection process literally consisted of checking the website, reading the whitepaper and maybe watching a couple of Youtube videos. That’s it! Funny enough this strategy did work just fine. Many investors thought they found new Klondike and bravely dived into this adventurous endeavor.

Why did it work? First, public awareness was rising very fast and the market was only preparing for the mission to the Moon.

Second, when the market was on the rise, pretty much all more or less sensible projects were surging as well. In crypto, we have a highly correlated environment. Here are some stats:

The matrix shows that in the selected months the whole market was pretty much moving together. Even though it was a period of a high activity, we have been observing the same strong correlation throughout 2018.

Thereby, the success of many “crypto experts” was mainly attributable to the market situation.

What went wrong

In January 2018, the temporarily overbought crypto market reacted with a sharp correction. Keeping in mind the correlation matrix, this correction affected every project and also airlifted a big part of the crypto community back to reality.

The returns on ICO investments not only slowed down but also turned to negative. However, the market situation is not the only problem. The year 2018 is the year for many ICOs to roll out their products and as some part of them wrote their whitepapers from scratch, it turned out that, so far, not every project is able to build a relevant, secure and a properly functioning product.

Recently, Earnst&Young published an update on their review of the top 141 ICO projects that in December 2017 accounted for 87% of funds invested in ICOs. In this follow-up study, they revisit the same group of projects to check the progress these companies have made. Here are the main points for our article:

86% of the projects are now below their listing price; 30% have lost substantially all value. An investor purchasing a portfolio of these 141 ICOs on 1 January 2018 would most likely have lost 66% of the investment.

Of the ICO start-ups, E&Y looked at, only 29% (25) have working products or prototypes, up by just 13% from the end of last year.

There were gains among selected projects, concentrated in 10 ICO tokens, most of which are in the blockchain infrastructure category.

There is also another statistic to support our point, it is the number of active addresses. As of October 22, only 26 projects have more than 500 active addresses in a 24-hour period.

This table shows that despite all the big words on websites and whitepapers a huge part of blockchain projects lack use cases and people just don’t use them, for now, they are mostly tools for speculation.

Consequences

On September 6, 2018, Fundstrat Global posted an interesting statistic, called “Alt-correction index”. The chart below displays that on August 22, 2018, 96.7% of altcoins were down 70% and more from 9-month highs:

This shows that investors are leaving beloved ICOs and trying to find a safer place in the crypto world during this storm. Most of them try to move their funds to the top coins, but even these assets are experiencing some significant bearish tendencies. For instance, ETH has plummeted even tougher than BTC due to the overall trend in the ICO market.

Recently BitMex published an interesting article named “Ethereum holdings in the ICO treasury accounts”, which is telling us about an economics behind of ICO funding and how these projects affect the price of ICO fuel

—

ether.

We see that this huge amount of ETH collected by ICO projects is downward pressuring the ETH price and till the majority of these projects won’t deliver products and get to the point when the operational profits will at least cover recurring costs, this situation will remain unstable.

Reaction from investors

As a result, we have a huge number of investors moving away from altcoins. However, holding even the top cryptocurrencies in 2018 is an arduous business, not everyone can watch at one’s portfolio melting every day. BTC price chart is far from being as mesmerizing as it was in 2017:

Trading in the crypto world is highly inconvenient and, as we all know, it is the place where retail investors usually lose money. Quitting crypto completely is not an option too. First, it’s a tough moral choice to leave at these prices, and second, the market shows signs of consolidation, so no one wants to miss the next bull run.

So what are the most adequate options for investors right now?

What to do?

Here we have a list of the most sensible strategies that investors may employ:

A. To hold coins of those projects that have backed up their words with action. We need to appreciate these rare specimens with a working product.

B. To move funds to the very top coins and forget about them.

C. To use robots and algorithmic trading tools. As far as hodling in 2018 is not the sweetest thing, more and more investors turn to active strategies.

Apparently, a wise move will be to mix these options and build a portfolio of strategies fitting your investment preferences. While with points A and B it is possible to do everything on your own, with the point C, technically speaking, not everyone can build a home-made trading robot. Thus it is much easier to use a readily available solution.

Blackmoon’s solution

To start with, we are the only operational blockchain investment platform. Yes, we are one of those projects with a product.

Today, we offer ten investment opportunities, six of them related to algorithmic crypto trading.

For those investors bullish on the crypto market’s future, we have an option to just index the market with our BMxT10 and BMxT20 tokens, which represent the top coins by market cap and are automatically rebalanced monthly.

For those looking for more active strategies, we currently have another 4 products. For example, BMxVTP token follows the performance of the most volatile coins, features trend protection mechanism to reduce downside risk and is rebalanced daily.

Finally, we have unprecedented for crypto industry products represented by tokens that follow the performance of assets from the world of traditional investments. It brings diversification of your crypto portfolio to a whole new level and lets you get exposure to traditional assets without leaving the crypto.

With these options already, investors can make a huge number of combinations for different risk/reward preferences. However, we are not content with these achievements and will continue to establish new standards in the field by constantly developing our product. Furthermore, we try to make our services available in as many countries as possible. Recently, we have opened our doors for US citizens, now accredited investors have an access to the investment opportunities on our platform.

Stay tuned for further updates as new options will be appearing in all of our product lines!

For more information: https://blackmoonplatform.com/showcase

Summary

First of all, it is impossible to make a solid investment decision based only on the website and the whitepaper. With such a small percent of projects with a working product, it is much safer to wait for some kind of an MVP and only then make final research and decision.

Second, the market conditions have changed dramatically, some of the working strategies are not relevant anymore. However, the market shows signs of consolidation, and despite bearish tendencies in 2018, the industry is still very promising.

Third, in current circumstances, investors are looking for new solutions, innovative investment products and various combinations of those. Some of the most appealing opportunities are trading robots and algorithmic solutions. These options are already available for investors around the globe.

We hope that this article will help our readers to navigate themselves in the current realities of the blockchain industry and will prevent them from possible risky or unreasonable decisions. Take care!

Handy links to stay tuned to our updates:

website: blackmoonplatform.com

telegram chat: https://t.me/blackmoonplatform

info video: https://youtu.be/6Ii0XckQOAE

DISCLAIMER

Investment in cryptocurrencies carries a high degree of risk and volatility and is not suitable for every investor; therefore, you should not risk the capital you cannot afford to lose. Please consult an independent professional financial or legal advisor to ensure the product meets your objectives before you decide to invest. Regional restrictions and suitability checks apply.

komentiraj (0) * ispiši * #

Who owns Blockchain: FinTech Blockchain-related patent ownership breakdown

Among the things that Blockchain technology has been praised for, so far, is that it is built on simple and well-known ideas which individually could hardly be named new and have been well-known for quite some time:

Asymmetric Encryption (US patent 4,405,829),

Hash Functions (Hans Peter Luhn in 1960s),

Merkle Trees (US patent 4,309,569),

Key-value Database (Charles Bachman in 1960s),

P2P communication protocol (Tom Truscott and Jim Ellis in 1979), and

Proof of Work (Cynthia Dwork and Moni Naor in 1993).

Today, anyone aware of these relatively simple ingredients and how they work together, could build their own blockchain ecosystem of whatever kind or functionality. Moreover, many well-known blockchain projects are developed from the open-source (free) code

—

anyone can freely use the source code to develop their own public or private blockchain system. They can do so without needing an application for a license from somebody and paying anything for the use.

But those should not celebrate too early, because to their surprise, particular solutions and ideas developed (even on such an open software) may turn to already be somebody’s intellectual property.

Who are the owners?

The highest wave of patent applications was spotted in 2016, a good deal of which successfully granted (mostly coming from Chinese and US companies).

Due to some differences in the legal landscape and reviewing practice of patent authorities, patenting blockchain-related solutions in the European Union is more troublesome than in the United States. As the President of the European Patent Office (EPO) Benoît Battistelli once claimed, EPO patent applications are subject to a more scrutinized review than in the U.S. Patent and Trademark Office (USPTO). It was further confirmed that, in their view, European patents are of better quality than their US counterparts. “It means we are sometimes not issuing patents which have been issued in the U.S.” Battistelli said in an interview to Reuters.[1]

As for now, within the EU, we can see only five granted patents all belonging to nChain (EP3295349, EP3295362, EP3295350, EP325719, EP 3268914).

The US formally goes right after China in numbers of granted patents.

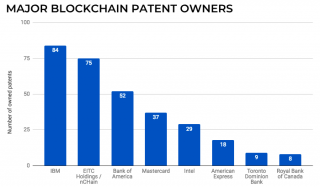

A patent “ownership” structure chart would display not so dispersed ownership

—

on the contrary

—

it would rather look like closely held family company, with the main holders being well-known big finance and tech companies.

According to Rimon Law Firm research, as of August 2018 the main holders of the blockchain-related patents were IBM with 84 patents, EITC Holdings / nChain

—

75, Bank of America

—

52 and others (please see the chart below).

What to expect?

Such a picture does not look promising for the future of the development of technology when the key ideas of blockchain application turn out to be captured by big corporations right from the start.

Despite all the looming concerns though, there is some hope there will be revisions of the emerging blockchain ownership landscape by the U.S. courts. The point is that when it comes to patenting software, it becomes a very delicate matter to determine whether a particular product may have a patent protection. It is not uncommon when patented software solutions, after years of success, fall down in court as “non-eligible subject matter” for patenting, i.e. those not deserving a legal protection.

Certainly, now we can see only the primary landscape of patent ownership, which might be redesigned after the forthcoming so-called “patent wars”.

We, at Blackmoon, are getting ready for any possible outcome of this situation. In particular, we are constantly looking to get patent protection for those technical innovations we implement to the Blackmoon Platform. This will not only protect such innovations from unauthorized use and implementation by other persons, but also protect us from the situation when other persons (who actively seek for patent protection of blockchain-related technologies) may try to restrict us to use any technology vital for normal functioning of the Blackmoon Platform.

__________________________________________________

[1] Andrew Chung. Europe issues better patents than U.S. -Europe patent boss [https://www.reuters.com/article/europe-patent-usa/europe-issues-better-patents-than-u-s-europe-patent-boss-idUSL2N1BR00H].

Handy links to stay tuned to our updates:

website: blackmoonplatform.com

telegram channel: https://t.me/blackmooncryptochannel

info video: https://youtu.be/6Ii0XckQOAE

DISCLAIMER

Investment in cryptocurrencies carries high degree of risk and volatility and is not suitable for every investor; therefore, you should not risk the capital you cannot afford to lose. Please consult an independent professional financial or legal advisor to ensure the product meets your objectives before you decide to invest. Regional restrictions and suitability checks apply.

komentiraj (0) * ispiši * #

WANT TO CAPITALIZE ON CRYPTO MARKET DECLINES? The first of its kind

—

The Inverse ETH Strategy by Blackmoon

22

prosinac

2018

How often do you witness a situation on the crypto market when everything is falling, but you do not have enough tools to take advantage of this opportunity?

The year 2018 entirely turns out to be an opportunity of this kind, which is, unfortunately, unavailable for most of the crypto investors.

Today, the vast majority of crypto exchanges only have two buttons

—

Buy and Sell, without an option to bet against the market. Even if available, short selling ties you up to the exchange, it is not tradable, not transferable and is subject to a possible margin call.

As a result, throughout 2018, hundreds of thousands of crypto investors have been forced to helplessly watch their crypto portfolios desperately melting down.

We’re all talking about this new technology and how it disrupts the traditional investment world, but it is the crypto investors themselves who are “blockchained” and forced to accept the rules of the game. This situation should not be allowed to continue.

Turning back to the chart above, imagine, just like in the fairy tale, Alice in Wonderland, we slipped through the looking glass and studied the same chart…but vertically flipped. Much better right?

What if we say that something similar is actually possible in reality and not only in fairy tales?

Ladies and gentlemen, we are proud to present, coming from the Blackmoon’s research labs

—

The Inverse ETH Strategy!

The Inverse ETH Strategy (BMxiETH)

The Strategy seeks to generate returns opposite to the performance of ETH. It provides investors with positive returns when ETH goes down and negative returns when ETH goes up.

The catastrophic lack of investment tools in the crypto world makes this product a unique and a one-of-a-kind opportunity to capitalize on market downturns and to diversify your arsenal of investment strategies.

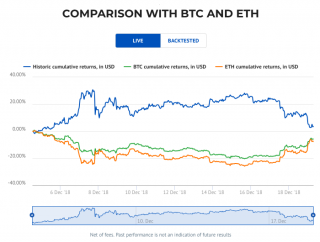

Without further ado, let us look at the backtested results:

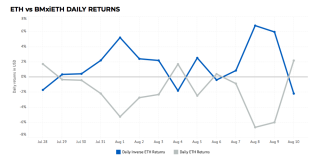

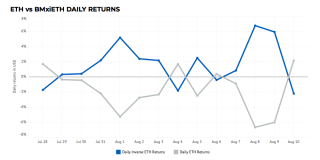

The results are truly mesmerizing! To now give you even more insight, let’s take a closer look at the backtested daily performance of ETH vs the Inverse ETH Strategy:

The Strategy seeks daily investment results, before fees and expenses, that correspond to the inverse (-1x) of the daily performance of ETH.

Unlike the short position, you can transfer BMxiETH, you can trade it or even hold it in your cold wallet.

We are excited to release such a game-changing product now when the crypto community in such a need for a stable environment with a wide range of investment strategies.

For more information on this revolutionary product, please, visit: https://blackmoonplatform.com/showcase/ieth

Stay tuned for further updates as new options will be appearing in all of our product lines!

Like this article? Give it a Clap!

Like Blackmoon? Follow us!

Handy links to stay tuned to our updates:

website: blackmoonplatform.com

telegram channel: https://t.me/blackmooncryptochannel

info video: https://youtu.be/6Ii0XckQOAE

DISCLAIMER

Investment in cryptocurrencies carries high degree of risk and volatility and is not suitable for every investor; therefore, you should not risk the capital you cannot afford to lose. Please consult an independent professional financial or legal advisor to ensure the product meets your objectives before you decide to invest. Regional restrictions and suitability checks apply.

komentiraj (0) * ispiši * #

The time of algorithmic crypto trading has come

Want to invest in highly risk market? Want to have massive gains in short amount of time?

"Shorting" and "longing", staying up late waiting for marktet to move is too much for you?

Blackmoon has solution for you!

“95% of all traders fail” is a widely known statistic and at the same time a forgotten facet of traditional trading. This has been a long-standing problem. Many individuals, instead of actively trading, choose to index the market or turn to algorithmic trading.

But how does this number look like in the realm of crypto trading? While there are many factors contributing to this fail rate, commonly lack of professionalism or psychology, the specificity of the crypto universe takes it to the whole new level.

In this article we review fundamental problems in crypto trading and propose solutions when the game is rigged.

POSITIVE OUTLOOK

You may say that nowadays the crypto market is highly inefficient, offers many opportunities and endlessly appealing for the sharks and whales hungry for the big scoops and tasty tidbits in the faces of average crypto traders. And you will be right. However, not only understanding of your position in this food chain matters, but also the economic viability of the time and energy spent on beating the market.

THE CHALLENGE

Let us now switch to the obstacles that, in our case, can turn 95 percent into 99. We will break it down into 4 categories each representing major headaches of the crypto traders:

Crypto trading peculiarities

Absence of trading sessions, or 24/7 trading, causes substantial inconvenience to everyone. Certain individuals are taking shifts with their teammates, while the others are setting price alerts that will wake them at midnight to take the necessary action. We plotted hourly data of Bitcoin trading volumes to show you that there is no constant periodicity and the volume explosions may occur at any time throughout the day and night.

Security and technical complexity

Have you ever heard this story about some random guy losing a significant amount of bitcoins along with his old hard drive? We can only imagine the number of digital coins buried under piles of iron. !ombined with the stolen funds during the cybercrime activities and the coins that were lost because of an error in the recipient address, it sums up to real money

On top of that, crypto trading tools, including trading terminals and exchanges, are far behind their counterparts from the traditional world. Today, on Coinmarketcap we have a list of 219 exchanges, and if you choose one, you do it at your own risk.

Lack of transparency of the crypto-related projects

Oh, dear reader, you have, probably, many times been faced with this problem when you spend about 30 minutes on yet another “disrupting the industry” company’s website and you have no clue regarding what they actually do and is there a working product or not. That is why even the most patient and deliberate investor may be subjected to the irregularity of the industry.

Market manipulations