Marketing

The time of algorithmic crypto trading has come

“95% of all traders fail” is a widely known statistic and at the same time a forgotten facet of traditional trading. This has been a long-standing problem. Many individuals, instead of actively trading, choose to index the market or turn to algorithmic trading.

But how does this number look like in the realm of crypto trading? While there are many factors contributing to this fail rate, commonly lack of professionalism or psychology, the specificity of the crypto universe takes it to the whole new level.

In this article we review fundamental problems in crypto trading and propose solutions when the game is rigged.

POSITIVE OUTLOOK

You may say that nowadays the crypto market is highly inefficient, offers many opportunities and endlessly appealing for the sharks and whales hungry for the big scoops and tasty tidbits in the faces of average crypto traders. And you will be right. However, not only understanding of your position in this food chain matters, but also the economic viability of the time and energy spent on beating the market.

THE CHALLENGE

Let us now switch to the obstacles that, in our case, can turn 95 percent into 99. We will break it down into 4 categories each representing major headaches of the crypto traders:

Crypto trading peculiarities

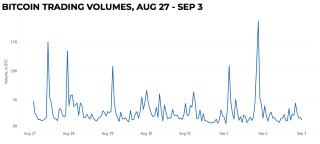

Absence of trading sessions, or 24/7 trading, causes substantial inconvenience to everyone. Certain individuals are taking shifts with their teammates, while the others are setting price alerts that will wake them at midnight to take the necessary action. We plotted hourly data of Bitcoin trading volumes to show you that there is no constant periodicity and the volume explosions may occur at any time throughout the day and night.

Security and technical complexity

Have you ever heard this story about some random guy losing a significant amount of bitcoins along with his old hard drive? We can only imagine the number of digital coins buried under piles of iron. !ombined with the stolen funds during the cybercrime activities and the coins that were lost because of an error in the recipient address, it sums up to real money

On top of that, crypto trading tools, including trading terminals and exchanges, are far behind their counterparts from the traditional world. Today, on Coinmarketcap we have a list of 219 exchanges, and if you choose one, you do it at your own risk.

Lack of transparency of the crypto-related projects

Oh, dear reader, you have, probably, many times been faced with this problem when you spend about 30 minutes on yet another “disrupting the industry” company’s website and you have no clue regarding what they actually do and is there a working product or not. That is why even the most patient and deliberate investor may be subjected to the irregularity of the industry.

Market manipulations

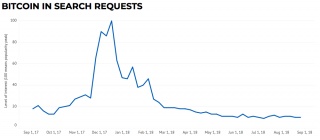

At a certain stage of development every crypto trader was in a pump & dump group chat. However, it is only a drop in the ocean as main actors on the stage are “whales” who time after time taking an advantage of less-knowledgeable investors by drawing whatever price movement they want. The chart below shows how the price manipulation has sharply risen the interest in the public, and we all know the end of this story.

SO THE GAME IS RIGGED, SHOULD I QUIT?

Not really. Some companies rose to this challenge and the Blackmoon Platform already has solutions for different types of traders

—

Crypto Strategies powered by algorithmic trading. The strategies are deliberately prepared by our Data Science team and are fully automated.

Let us walk you through the major types of traders and existing solutions:

“HODLERS” and Position Traders

These individuals do believe in the bright future of the blockchain, hold their coins from months to years and do not depend much on potentially misleading news and temporal price swings.

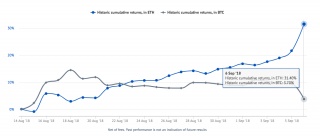

Solution: Blackmoon’s Top 20 Market Cap Crypto Strategy

The strategy lets you get the market exposure by buying just one token which is the asset token of the strategy tracking coins with the largest market capitalization in the previous three-month period. The core objective of the strategy is to generate the returns corresponding to the yield of the cryptocurrencies with the largest capitalization.

In just three weeks, the strategy has already shown solid performance in USD (+14.5%) and continues to outperform the market yielding a remarkable return of 31.4% in ETH and 3.7% in BTC!

Day Traders and Action Chasers

If you hold your coins no longer than day or two and you are obsessed by huge price movements, possibly, you belong to this category.

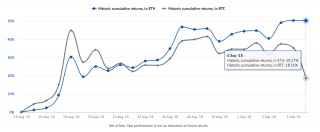

Solution: Blackmoon’s One Day Most Volatile Crypto Strategy

One Day Most Volatile Strategy token is the asset token of the strategy tracking the cryptocurrencies that have had the largest volatility in the previous 24 hours. The objective of this strategy is to generate the returns corresponding to the yield of the crypto assets with the largest volatility.

In just three weeks, outstanding results of this strategy are marked the +30.9% return in USD and yielding stunning returns in ETH(+50.2%) and BTC(+18.5%)!

Swing or Trend Traders

These individuals open their positions, sometimes gradually, at what they calculate to be the local bottom, then they hold the position all the way to what they believe to be the local top, most of the times gradually scaling out of the position to lock in profits. Swing trading is generally done over the course of days or weeks.

Solution: Blackmoon’s Daily Delta Rebalancing Crypto Strategy

Daily Delta Rebalancing token is the asset token of the strategy focusing on delivering alpha to ETH by adjusting the basket of the top 6 market-cap of coins and cash. The core objective of the strategy is to generate the returns corresponding to the yield of the top 6 cryptocurrencies with the largest capitalization providing downside risk protection by dynamically allocating portfolio between cash and crypto.

While the strategy currently falls behind the other two, it left the “red zone” and shows what it was created for by outperforming ETH even when the market plummets.

For more information: https://blackmoonplatform.com/showcase/ddr/aboutase/ddr/about

CONCLUSION

There is a belief that selling is backward-looking and buying is forward-looking. Investors buy coins because of their expectations and sell them because of what has already happened. In most cases, this leads the majority of investors selling winners and holding losers. In addition, many retail investors do not stand up to the psychological pressure of the crypto market with all these price swings of unimaginable scale.

Machines, in turn, do not sleep, nor do they tremble before unexpected price movements. They just automatically execute the predefined algorithm and do it cost efficiently.

So is it worth trying to hit these 5% of winning traders? Or it is better to save you time, energy and nerves by using algorithmic trading and investing in fitting your goals and personality set of strategies?

You should do you own research and weigh all the pros and cons before making the decision. On our side, we will keep the pace and introduce new crypto strategies in the nearest future. Stay tuned for further updates in the investment opportunities on our platform!

Handy links to stay tuned to our updates:

website: https://blackmoonplatform.com

telegram chat: https://t.me/blackmoonplatform

info video: https://youtu.be/6Ii0XckQOAE

YouTube Channel: https://www.youtube.com/blackmoonplatform

parent company website: https://blackmoonfg.com

DISCLAIMER

This article provides you with educational material only and was prepared by Blackmoon team for information purposes only. Cryptocurrency markets are unregulated and carry a high degree of risk, including a risk of loss of entire investment. Only risk capital you can afford to lose.

Past performance does not guarantee future results. Trading history presented is less than 5 years and may not suffice as basis for investment decision. This post is not intended to be investment advice. Before deciding to invest, you should seek independent legal and professional advice.

Post je objavljen 27.10.2018. u 16:42 sati.