Reverse Mortgage Pros

petak , 27.01.2017.Just What Exactly Is A Reverse Mortgage Pros ? Information For People Resident In Canada

For those Canadians out there that are interested in info pertaining to a reverse mortgage, this article is for you.

I must also preface this write-up by saying that 'reverse mortgage' is the phrase used for the product in both Canada and the States - but the rules and policies in the countries are miles apart - so the 2 products are very different.

This is essential to keep in mind too as it is a big factor behind the reasons that a reverse mortgage is not well understood throughout Canada - often times they are confusing them with the American version.

There is so much incorrect information concerning reverse mortgages in Canada, so it can often seem hard for you to know where to begin.

I assure you that during your reverse mortgage choice you will come across, at the very least, one piece of data from a person that is entirely incorrect - which they possibly obtained from an American reverse mortgage web site.

So I am going to attempt to clarify this incorrect data and offer you the basic info and facts you require about a reverse mortgage pros in Canada.

The History On A Reverse Mortgage In Canada

A reverse mortgage is an item just readily available to Canadian home owners aged 55 and over.

In Canada all residents (not just you) should more than 55 years to qualify for a reverse mortgage (I think it is 62 years in America).

There are specific locations that are excluded - speak to a specialist to obtain the latest on these as this could be in motion as a reverse mortgage is available in even more parts of the country.

A reverse mortgage is a home mortgage - because it is safeguarded against your house - however it changes to a routine mortgage in lots of means.

To start with, no normal repayments should be made

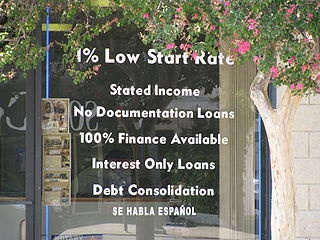

Aside from the absence of monthly repayments, it doesn't come with several of the other inconveniences that getting a routine mortgage does - your credit report and income are not important and not analyzed as any part of the application steps.

and since you don't need to make regular monthly repayments, there is no factor for the lender to ever take your home (for missed out on payments) - as a matter of fact it is included in the legal contract that they are not allowed to.

So, after reviewing the above, you may be asking yourself - if it is so distinct to a routine home mortgage, why is it still called a home 'mortgage'? This is an outstanding question and - as I will certainly discuss below - Canada and the U.S.A are the only countries worldwide where it is called a reverse mortgage. Other nations make use of different names due to the fact that the product is so distinct. This is among the reasons for so much complication concerning them.

In addition to the above factors, the significant difference in between a reverse mortgage and a routine mortgage is that the loan interest is just accrued versus your house - this basically means that it is added up and just settled when your home is sold off or remortgaged when the property owners pass.

This suggests that with a reverse mortgage the balance owed grows a little each year - unlike a routine mortgage where the amount would be decreased each year as you make payments.

If you are wondering exactly what takes place to the reverse mortgage amount owed, well exactly what happens is that when the homeowners pass away, their estate sells the building and pay it off.

The quantity that they get back is can never be more than the value of your home - that is they can never ever send your relatives and your heirs a bill for anymore than your home value.

Second of all, you very seldom should stress over the reverse mortgage even expanding this high - in fact 99% of Canadian properties have equity staying (a leftover amount of money) after the home is sold off and the reverse mortgage has been repaid.

So don't worry about leaving a large expense behind you - this is literally impossible.

What Exactly Can The Funds Be Used For?

As there is no check on your income or credit history, you can use reverse mortgage pros funds for anything you choose to.

The most common usages of a reverse mortgage in Canada is to pay off a current mortgage, to ensure that you dont need to make those troublesome regular monthly payments.

It ought to be noted that settling any type of existing home mortgage first of all is actually mandatory to obtaining a reverse mortgage - only after that can you keep the excess cash. For example, if you have a $100k home mortgage and secure a $200,000 reverse mortgage, you need to repay the $100,000 home mortgage initially and then you keep the various other $100k.

I might note a million reasons that I have actually seen clients utilize a reverse mortgage however you possibly already have your own. Or you just want some additional money for retired life - this is once more an incredibly popular reason to take a reverse mortgage out.

These additional funds for retirement could be taken as one big lump sum or regular month-to-month payments.

If you are fretted about the tax man coming to visit, you also do not should be - all cash is tax free as you are just taking a bit of the equity out of your property that you already have.

Who Should Consider Obtaining A Reverse Mortgage?

Well, I would first of all answer this question with a further concern - one that is quite essential - do you really require the money?

Maybe you have issues making your monthly mortgage payments on a monthly basis and wish to free up this cash or you just require the cash for one of the reasons noted above, this is the primary reason for a reverse mortgage.

If you require the money and you have a great deal of cash invested in your home (it is among your greatest assets) - then a reverse mortgage may just be the solution you are trying to find.

There is a reason it is called a 'Home Pension' in Japan (more on this below).

If you are simply looking to have accessibility to money in an emergency then I would definitely take into consideration a Home Equity Credit Line as an alternative and, second of all, take into consideration waiting till you really require the money before applying for a reverse mortgage.

This Financial Solution Around The Globe

I wanted to finish by talking about reverse mortgages in other places.

As I discussed previously, the term reverse mortgage itself is a little confusing due to the fact that it differs so much to a routine mortgage.

Only in North America is the term reverse mortgage used - which leads to much of the confusion surrounding them.

Well, I think that looking at these other names for the product around the globe is in fact rather mind-blowing since they explain the product much better than the name 'reverse mortgage'.

In the UK and other nations a reverse mortgage is described as a 'Pension Plan On Your House'. I like this description as it is ideal - much like how in a regular pension you put money in over your working life (your mortgage payments), the money usually grows in worth (house value growth) and then you can withdraw some of it when you require it upon retirement.

And home pensions (or reverse mortgages if you want to use the boring name) are really exceptionally popular in Canada and around the world just now.

Canada isn't the only western nation with an aging 'baby boomer' generation - much better healthcare and other reasons like this have actually resulted in a lot of western nations to see a more aged typical demographic.

In addition to this, shifts in both personal and public pension plans over the past few generations have led to many individuals to not have enough cash for their retirement.

So, many people now find themselves in the situation where their house is among their biggest monetary assets - much larger than their pension - and they wish to take out some of the equity they have actually earned in their house throughout the years to supplement their retirement income.

This short article was written as a basic overview of this financial solution - I highly encourage that you seek professional guidance and do additional research before finalizing your very own choice. Visit us http://www.reversemortgagepros.ca/reverse-mortgage-secrets

komentiraj (0) * ispiši * #